The Power Trend System is Programmed to Get Your Trades to Breakeven Quickly

Why The “Breakeven” Trade is a Winning Strategy

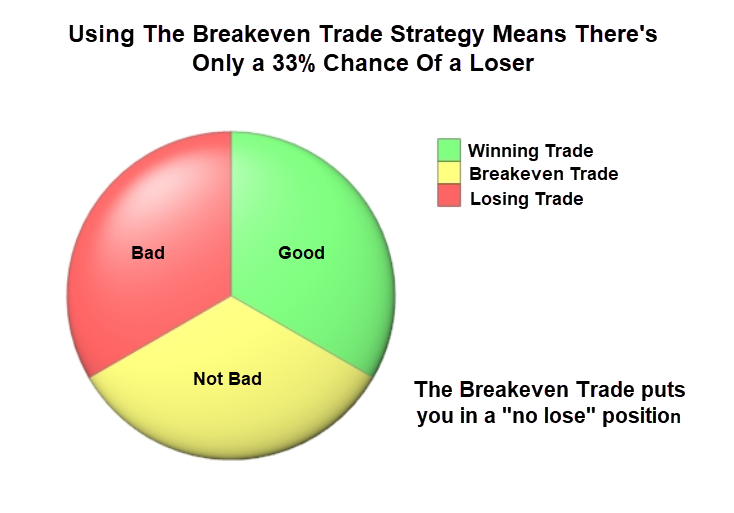

Most traders approach each trade with one of two expectations – win or lose.

A break-even trade is simply one where you didn’t win or lose, but eliminated the possibility of a loss – by moving your (initial) stop to breakeven.

Getting your stop to break-even eliminates the risk of a loss. – Breakeven Trades Stack the Odds in Your favor

So instead of a trade only having 2 potential outcomes – win or lose, we have introduced a third outcome. And now, two out of three possibilities guarantee you won’t lose money on a trade.

Employing the breakeven trade means “less percent of your trades are losers”.

The break-even trade provides us with an “edge” and reduces risk.

Using a break-even strategy increases our odds over a series of trades.

The key is “ratcheting” the stops at just the right time – to get to breakeven.

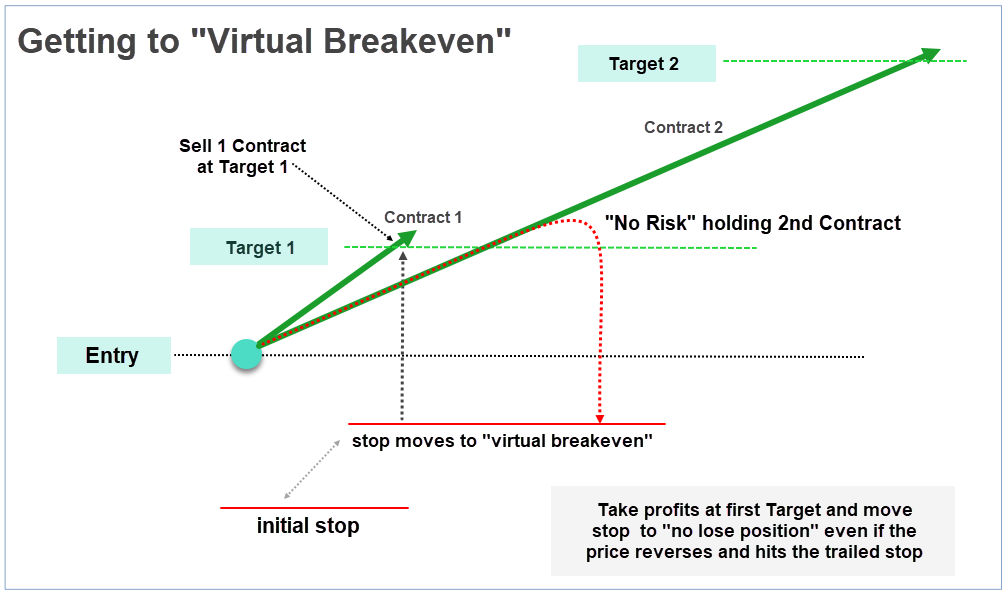

In the Futures market, if you’re just trading 1 contract – in order to get to breakeven – you’d have to have enough movement in the direction of your trade to be able to move the stop to your Entry. You also need to make sure you leave the price enough wiggle room so that the “ratcheted” stop doesn’t get hit almost immediately.

This is why trading 2 Contracts (minimum) makes the most sense and is the basic strategy of the Power Trend System.

It allows us to take profits at an “east to hit” first Target (1) and moves the initial stop up to “virtual breakeven” (Not the Entry).

Virtual Breakeven is the exact level at which you can’t lose money on the trade.

Here’s an example:

Say we get an Alert to go Long and trade 2 Contracts. We get a fill (Entry Confirmation) and Target 1 is 4.00 points. The market continues higher and we sell one Contract at T1, taking partial profits at that target. The system will instantly ratchet / trail the initial stop up to the level that guarantees a maximum -4.00 point loss if the market reverses back down and hit the trailed stop.

Most people think of a breakeven trade as “getting the stop to your Entry” however that strategy doesn’t allow enough “wiggle room” for the price to move without hitting the stop repeatedly. In other words if you just move your stop to the entry – you are going to get stopped out over and over.

When managing your stop-loss it’s important to give price enough leeway for normal fluctuation – without getting stopped out. Taking partial profits at T1 and moving the stop to “virtual breakeven” provides that extra room for the price to fluctuate and not get knocked-out of a trade prematurely – only to watch the price resume its trend in the same direction.

Here’s the most important point:

Once the system gets the initial stop to virtual breakeven – there’s unlimited opportunity for more gains, without any risk of a loss.

———————————————————–

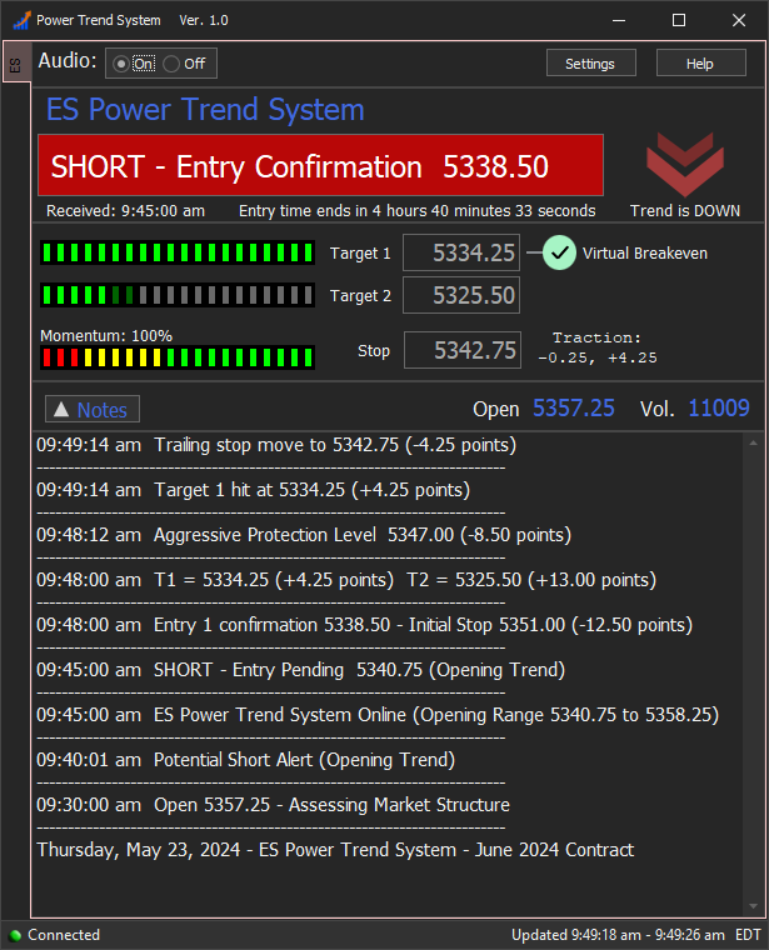

The Power Trend System “automatically” employs this “Breakeven Strategy”.

When a Trade Alert gets filled, it instantly provides 2 Targets and the initial stop. When the 1st Target gets hit, it “automatically ratchets” the Trailing Stop to the breakeven level. At that point there’s no risk of a loss on that trade.

We’ve found that using a mechanical approach to trading works best. It removes emotions from the equation and eliminates the difficulty of making decisions on the fly.

The Power Trend system is programmed to use the trailing stop-loss to make the selling decisions for us. That way there’s no guesswork involved, and it lets the market price behavior tell us exactly when to sell.

Getting the stop to Breakeven Eliminates All the Stress – and Means that We Can’t Lose Money on the Trade. That’s a Good Feeling.

The Power Trend System computes A Trailing Stop-Loss Order so We Always Know EXACTLY When to get to breakeven and where to take profits. Better yet, the stops are based on the current ATR’s and ranges in the market at the time – so it’s “dynamic” and will adapt to any market environment.

And as I mentioned, one of the key aspects of the system is that it moves the initial stop to breakeven as soon as the 1st Target gets hit. So all we need is just enough follow-through on a trade to get us to the 1st (relatively) easy to hit target – then we’ve eliminated the possibility of a loss.

Taking it a step further – when Target 2 gets hit, the Trailing Stop automatically moves to the exact Entry level. So there is no risk of a loss on any additional Contracts held past Target 2. The Trailing Stop is designed to get to Virtual Breakeven – Entry Level Breakeven – and then protect profits as price continues to move in our favor.

Here’s the best part. Using this “Delta Neutral” stop move / Breakeven strategy, you will increase your odds over a longer series of trades. This little scaling trick provides us with an extra edge in the market mathematically and it also reduces stress from day to day. That’s because every time price gets to our “easy to hit first target” and we take profits, the trade is in a no-lose position.

Here’s an example of a Short Alert that triggered-in and has just hit Target 1. Notice that Target 1 was -4.25 points below the Entry price and the moment T1 got hit, the Trailing Stop moved to exactly 4.25 points above the Entry. At this point, if the trade reversed and hit the trailed stop, it would be a “breakeven trade” – assuming you were trading 2 contracts and selling one at T1 to lock-in the 4.25 point gain.

Conceptually, the idea of locking-in partial profits and getting the stop to virtual breakeven gives us a distinct advantage as traders. It increases our odds and gives us an “edge”.