How to Take the Entry on Power Trend System Alerts

When the Alert Software issues a trade alert, there’s one final step before you actually pull the trigger and enter a trade.

This is called the Entry Confirmation or Entry Trigger.

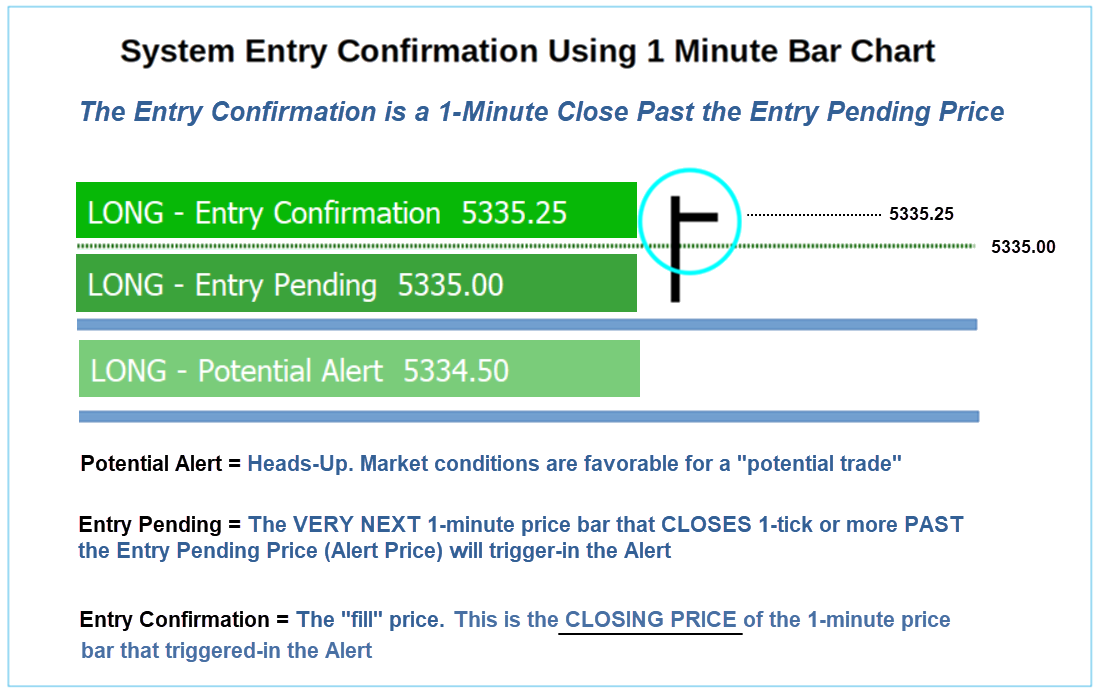

The Trade Alert “Entry Pending” represents a “Line-in-the-sand” or “Price level to beat” before we pull the trigger on a trade. The basic system trade entry confirmation is to wait for a 1-minute bar close PAST the “Entry Pending” Price Barrier AFTER the alert is received. If you wish to follow the system mechanically you must wait for a 1-minute closing bar AFTER you receive the Entry Pending alert price level.

Note: A Potential Alert is just a Heads-Up. You will typically see more than one Potential Alert with different price levels prior to an Entry Pending Alert. The Entry Pending price is the “Alert Price”

Entry Confirmation Notification

After an “Entry Pending” Trade Alert is issued you will want to monitor the price action on a 1-minute chart and wait for the very first 1-minute price bar to close – at least 1-tick or more past the Entry Pending Price “Barrier” – and then you click to “Enter at Market” long or short. As soon as the Alert Software detects there has been a 1-minute price bar close past the alert price – it will automatically print the “Entry Confirmation” line in the System Notes of the software – using the CLOSING price of the 1-minute price bar that triggers-in the Alert.

(This means entering Long or Short “at market” should give you a fill very close to the system Entry Confirmation price)

Generally speaking, when the software issues an Entry Pending Alert it gets filled relatively quickly. Sometimes it will trigger-in on the very next 1-minute price bar. Sometimes it will take 5-10-15 minutes before we see the 1-minute close past the Alert price. And sometimes the Alert never triggers-in and price moves in the opposite direction.

If an Entry Pending Alert doesn’t trigger-in within 15-minutes, the system will “reset” back to Hunting Trade Setup

It’s possible to see a series of Alerts that never trigger-in because of our Entry Rule. If there’s no 1-minute close at least a tick past the Alert price / Trade Price Barrier then that Alert doesn’t “confirm” an Entry.

Understanding the Dynamics of the Entry Trigger

There are a couple important reasons why the Entry Trigger is designed this way – rather than just entering a trade as soon as the price moves above or below the Entry Pending Alert Price.

First, it gives you at least 1-minute to react. You might be on the phone, looking at the TV or reading an email when the software gives a Trade Alert. The audio alert gives you a heads-up that a potential trade is about to happen. So you have at least 1-minute to focus your attention on your trading platform and get your hand on the mouse – ready to pull the trigger and enter a trade.

In a fast market if we didn’t confirm the entry this way, the price may have already made a huge move and you missed it because there was no time to react.

Second, we want to confirm the momentum in the market – in the direction of the alert. Many times the price will spike up for a split-second and then go right back down. Sometimes this happens repeatedly before the price is actually able to CLOSE over the Pending Trade Barrier. By waiting for a close past the barrier we are letting the price prove that it has at least enough energy to close past the barrier on a 1-minute chart and is more likely to get additional traction in that direction.

Many times we will see a bunch of 1-minute price bars poke through the Entry Pending price but none are able to close past it – then the price reverses. This “entry confirmation” strategy helps prevent us from getting sucked into a false move.

Other times the market is making a strong move and the very first 1-minute bar after the Pending Alert is issued closes past the Trade Barrier.

The time between the Entry Pending alert and the Entry Confirmation is a function of the price action.

That brings us to another important consideration – the actual fill on the order.

The Entry Confirmation (fill) may be a couple / few ticks or a couple / few points past the “Entry Pending Alert Price”.

Depending on the price action in the market, the actual fill may be a tick or two past the Entry Pending / Alert Price or it may be several points past it. Don’t worry about this because it’s built into our strategy and over a long series of trades it won’t matter.

The distance to the Targets and Initial Stop is calculated based on the Entry Confirmation price. However fills that occur significantly past the Entry Pending price can have more risk and a higher chance of hitting the stop. It’s just something to recognize. Also keep in mind that the Targets and Stops are relative to the ATR’s and volatility in the market at the time.

Remember, everything about the system is “dynamic” so market conditions will determine how everything plays out.

In some market environments Target 1 might only be a few points and in volatile markets it could be quite large. The system uses the current real-time ATR’s and ranges in the market to determine all the levels. These can vary dramatically intraday and from session to session. This ATR based strategy allows the system to self-adjust for any type of market conditions and environment.

Tip: Use the Seconds Timer in the lower right-hand corner of the software to know exactly when the 1-minute price bar is getting ready close.