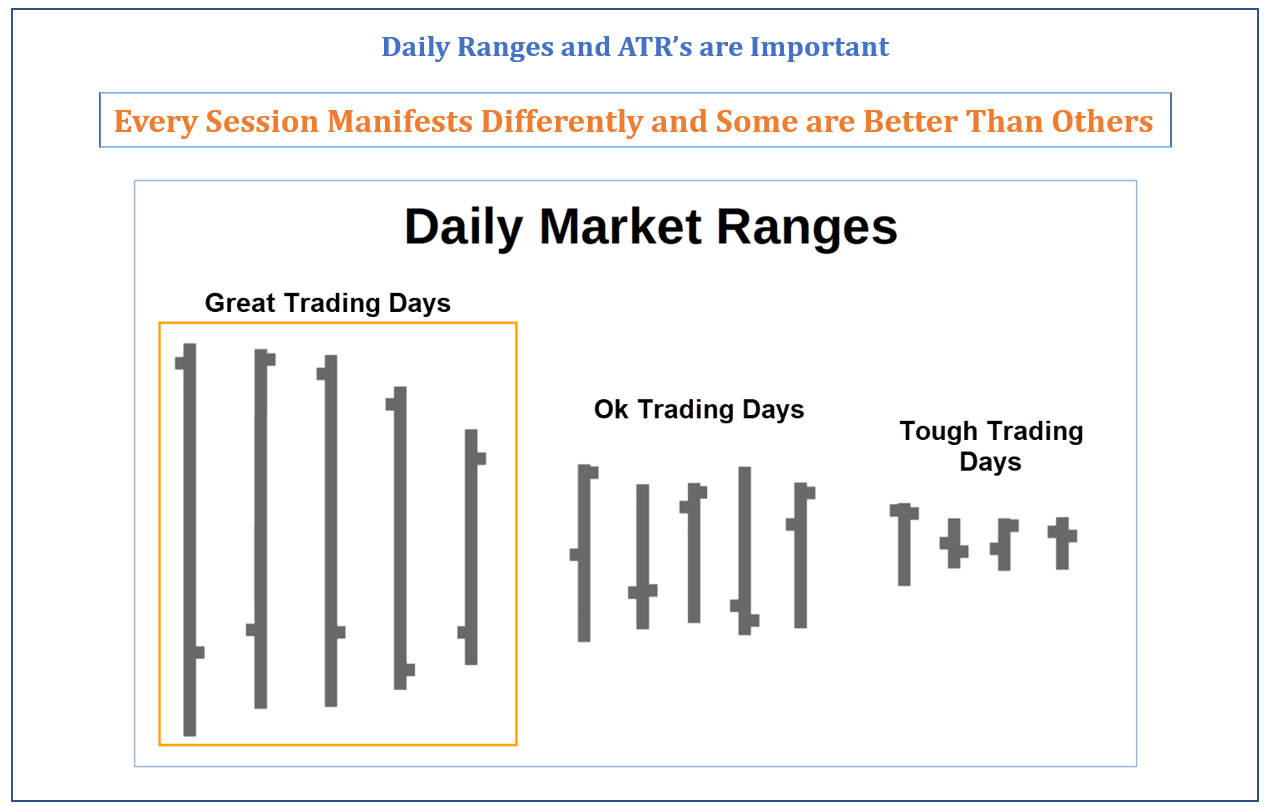

Market Conditions Affect Trading More Than Anything

Ideally the market would serve up great trading days every session – but it just doesn’t work that way.

Most traders have a hard time handling the day-to-day inconsistency of price action. Underestimating the trickiness and day-to-day personality changes in the futures market can completely throw a new trader off balance before they even have a chance to find their sea legs. There is this idea that the market is orderly and cyclical and has some secret underlying “mathematical symmetry” which just has to be discovered and tapped into to be able to cash in big. Market price movement is NOT consistent – which easily throws a monkey wrench into most trading approaches. We may see several days of low momentum chop followed by explosive trending action for a few days which can take you by surprise. The Power Trend System does not try to figure out the market and instead focuses on how to play it.

We cannot “Figure Out” the market – we can only attempt to exploit it.

We can’t force the market to behave in a certain way – or expect that it’s going to accommodate our style of trading every session. Some days the price action is so dull you’re better off doing anything than trying to trade. This is especially true in sideways markets. I’ve seen price clang around in a few point range for hours on end without offering any decent trading opportunities.

The Power Trend System is extremely selective in choosing when to give an Alert.

It is even MORE SELECTIVE when it comes to triggered Alerts. In other words you might see LOTS of “potential alerts” come and go throughout the session before one actually triggers-in a trade. There will be sessions where there’s one alert all day and it happens mid-day or in the afternoon.

It’s imperative that we are patient when the market is not trending or exhibiting the type of price action that is conducive to taking trades.

There is nothing wrong with being extremely selective with our trades. It beats getting chopped up or trying to scalp for peanuts and racking up a bunch of commissions.

We have to trade what the market is serving up today.

It’s important to be patient and not get frustrated in dull markets and realize trades will materialize and conditions will improve – they always do. Trading out of boredom – or forcing trades just because you think “I’m a trader I need to be trading” is one of the pitfalls many people fall into. That’s also related to the problem of over-trading. Some people think they need to constantly be jumping in and out just because the market is open. If there are no waves, you can’t surf. If there’s no wind you can’t sail.

This is extremely important when it comes to intraday trading because the “big move of the day” might not occur until a couple hours into the session or longer. The market has a tendency to “bust a move” shortly after the open, then go into a period of sideways chop on some days. Other days the choppiness occurs right around the open and then maybe economic news is released at 10:00 (eastern) and then the action picks up.

I’ve studied intraday price behavior for years and I can tell you that the price action manifests differently in every trading session. The key to successful trading is waiting for the “right price action” and setup to pull the trigger on a trade – and that may or may not happen in the first hour of trading. It may or nay not happen before Lunch. But being selective and only taking the high-probability setups WHEN THEY OCCUR is how to win in Futures trading.

The Power Trend System does not attempt to predict what the market will do. It reacts to how the price action is unfolding.

Knowing when NOT to trade is as important as knowing when to trade.

Every market session is unique. The price action manifests differently.

Some mornings when the opening bell rings, the price just takes off in one direction and never looks back. This “directional opening drive” can last an hour into the session or all day. The software displays the Open price as a reference point.

The Power Trend System incorporates what we call the “Opening Trend Continuation Alert” which basically analyzes pre-market and early cash session price action and decides if there’s a “significant” trend already in progress that we might want to hop on. This gives us an early morning opportunity for those days where price moves in one direction all day.

Other mornings the price chops around for a period of time before picking a direction – if at all. These mornings we may not see any alerts for some period of time. There are certain sessions where it takes an hour or two for a tradable trend or a trend reversal to develop. It’s important to realize that it may take time for the system to identify a high-probability trend setup. When price is meandering all over the place with no discernible Primary Trend, the system will sit on the sidelines and wait for the right opportunity.

We tend to see dull price action around lunchtime (East Coast). The action is usually better in the morning and afternoon, but that can vary from day to day too. There’s “seasonality” that comes into play too. Mid to late summer is typically dull. The week between Christmas and New Year is not usually the best trading environment either.

Keeping your expectations relative to current market conditions is the correct approach.

Intraday market conditions can vary drastically.

Most market sessions experience varying degrees of intraday “action”. Things can start off slow and then pick up later in the session. Or price can “bust a move” right out of the gate and then settle into a sideways pattern for a period of time. There are sessions where the price moves significantly in one direction for a period of time, then reverses and gives it all back. There’s almost an infinite number of ways the price action can manifest intraday, but the key is getting the current “directional trend” right. This is what the Power Trend System was designed to do.

But there are always limitations. Some trends are tight and smooth and some are wide and choppy. Not all trends are created equal. The job of the software is to identify the trends and trend reversals that have the highest probability of following-through. The Trailing Stops help protect us when there’s a “trend failure”.

The system will miss some trend moves. Maybe a trend develops but the price action doesn’t have the momentum to trigger-in the Alert within the 15-minute window. Don’t fret because it will be in a position to catch the trend reversal when it happens.

Some sessions we may see narrow ranges and ATR’s early in the day and then the volatility and ranges expand later in the session. Or vice-versa. Keep in mind that everything about the system is dynamic and the distance to the Stops and Targets are based on the current ATR’s in the market at the time. During periods of high volatility we may see Target 1 at 8-10 points or more and when things are dull Target 1 could be 2-3 points.

Slow Markets – Fast Markets – Normal Markets

Market conditions generally fall into 3 categories. And these can last for weeks or months.

Slow markets are typical in mid to late Summer where it may seem like the price action is moving in slow motion – trading like molasses. The price tends to trade in a dull choppy range and there’s a tendency for erratic almost random price moves. Often there’s no “flow” to the action – it’s choppy, dull, boring and typically sideways for periods of time. We also tend to see this type of price action with the VIX under 20. Slow markets are common during consolidation periods on the daily timeframe. In other words, when the market has a “run” on the daily timeframe, generally speaking it reaches a level where it begins to consolidate the move. The price action slows down and the ranges contract. You’ll see a series of Doji’s on the daily chart and price is likely to be range bound. Slow narrow-range markets aren’t all that conducive to trading.

When the VIX is under 20 we’re likely to experience “slow market sessions” more frequently.

Normal Markets – is there such a thing? Yes, and they are the best trading environment overall. There’s good volume and price movement, plenty of trending action and the market participants are engaged. There’s more directional price movement and less overlap of price bars (candles). There are less seemingly random moves because there’s a flow to the price movement.

Fast markets – these are usually the best conditions for scoring big points – but also come with the most risk. Examples of fast markets are the Pandemic sell-off where SPX price was moving 1-2% a day. And the beginning of 2022 when Russia invaded Ukraine. Prior to that the 2016 election and the period of time around Brexit (if you remember back that far). Fast markets are a double-edge sword because the price can move 20-30 ES points in the blink of an eye. I remember seeing ES move 30 points in a 1-minute price bar. (talk about risk) A lot of newer traders may not have experienced “fast markets” except maybe on Fed days or brief periods around news releases.

HERE’S A FACT: THE MARKET WILL EXPERIENCE LONG-RANGE DAYS – GUARANTEED

By long-range day I mean a session where the price trends significantly in one direction. A day where ES moves say 30-50-75 points in one direction from open to close. In slow market conditions you might go a couple weeks without having a BIG up or down day. In volatile periods you might see several days like that in the same week or two week period. You might see several days in a row where the market makes huge moves – typically as the result of some news events or something happening in the world.

Long-range days by their nature are strongly trending days and are ideal for the system.

Since we know there will be – and always has been huge intraday moves – the question is – can we be patient and wait for them to trade aggressively? Or are we going to blow our account being over-zealous trying to force trades when the market is flat? And do we have a plan for when those big trending days happen – to take advantage of it and score the BIG points?

YES – the Power Trend System software handles that for us.

We received a comment that said “The biggest problem I’ve always had was holding onto winners long enough to score big points. I always sell to quickly”. So that is the big conundrum. How do you “let your winners run” as the saying goes? Well, it plays into everything I’ve been saying here. Adjust your expectations and trading based on market conditions – and when things heat up – THEN you shoot for the big scores. The Power Trend System actually handles this for us automatically as everything is based on the current ATR’s in the market at the time – and from day to day.

The important point to keep in mind is that you have to adjust your expectations based on the current market behavior. And you have to adopt a mindset that allows you to be patient when market conditions are not ideal. Overtrading out of boredom and forcing trades with mediocre setups is how most traders blow their account. The better approach is to be patient and only swing at the “fat pitches”.

Catching One or Two of the Big Moves of the Session is the Best Approach

This beats “grinding it out” all day trying to scalp a couple points here and there and racking up a ton of commissions. Ideally there will be a couple sessions a week where the system will give an alert right after the high or low of the session is in. In order to trade a trend reversal we must be patient and let the trade setup set-up. Sometimes this doesn’t happen until mid-session or later.

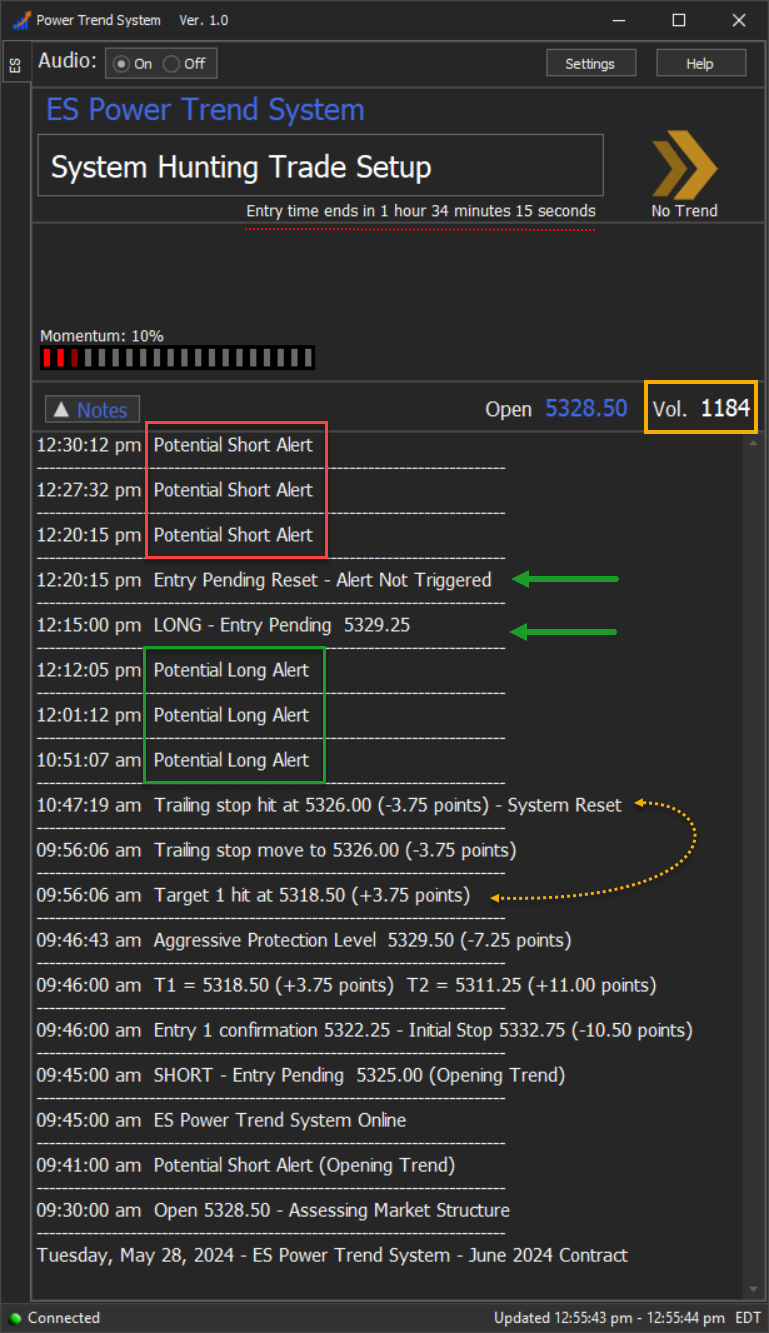

Here’s an example of what you might see over a typical dull market session.

On this “Tuesday after Memorial Day” there was an Opening Trend Continuation Alert that triggered and went on to hit Target 1, but after that the market went into a choppy, directionless sideways mode for several hours.

Notice the series of Potential Long and Short Alerts. One of the potential longs actually turned into a Pending trade, but it never triggered-in and you can tell by the subsequent series of potential shorts that the price reversed. In other words, no real trend developed and the system kept us on the sidelines. Which is perfect because the price action at the time was just a mess. Anyone trying to trade during that period likely got chopped-up and stopped-out.

Notice the Volume indicator is shaded in White because the average number of Contracts being traded (over a 3-minute period) was only 1184. Generally speaking anything under 2k is low volume / participation and the indicator turns Blue when volume exceeds 2k contracts per minute.

I underlined the “Entry Time Ends…” countdown clock to show that this screenshot was taken well into the session. If there are no Open Alerts at 2:30 eastern time, the system goes offline for the rest of the session.

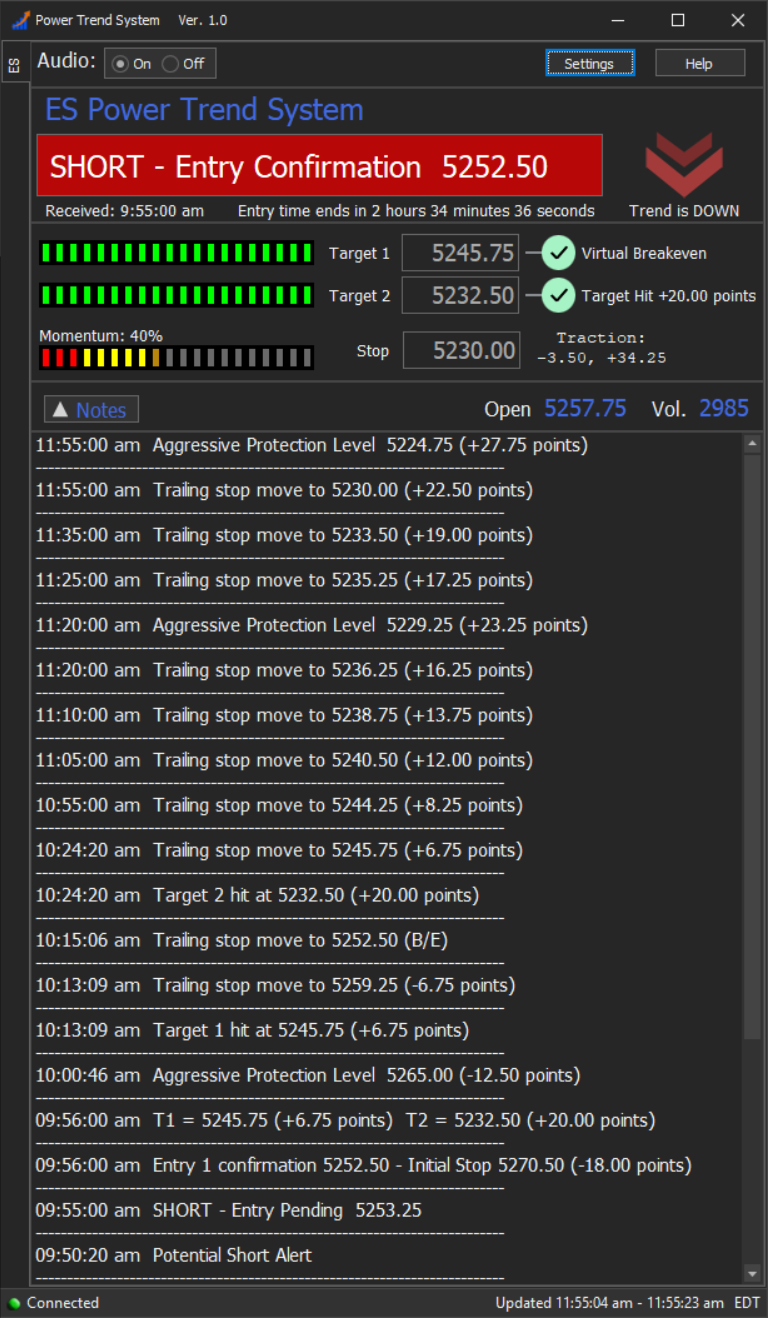

Here’s an example of what you might see over a strongly trending market session.

(Read the System Notes from the bottom up)

The Screenshot above was taken just before Noon on 5/31/24, the last trading day of May. There was a strong downtrend move early in the session and the system caught the move and played it well. But the most interesting thing to note is the sequence of Trailing Stops and how the system “protected profits” even after getting to Virtual Breakeven and actual Breakeven.

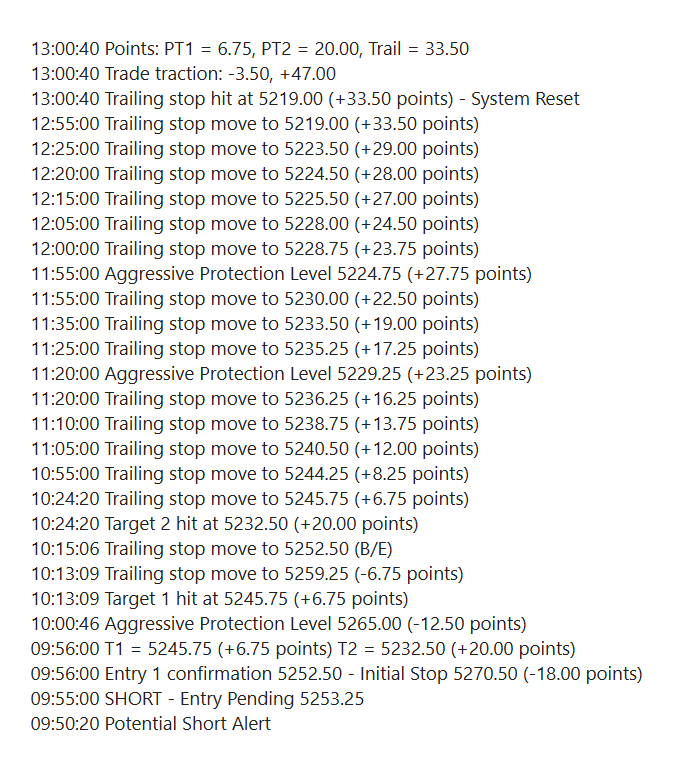

The screenshot of the software above wasn’t able to capture how the entire trade played out from start to finish due to size restrictions, so here’s the actual final “System Notes” recap once the Trailing stop was hit at 1:00 eastern time:

Everything is pretty self-explanatory, but it’s interesting to note the summary at the top indicating a “Runner” Contract scored +33.50 points in addition to the +26.75 points locked-in at T1 and T2. This is an example of how the system handles a strong trend move and how the Trailing Stop protects gains.

To Summarize:

The two examples above are from the same final week of May, 2024 and show how vastly different any one session can play out. We see a dull, sideways session and an action-packed session with a substantial trend. So the key takeaway is to realize some days are going to be “nothing days” maybe a breakeven trade or two, maybe no Alerts fill at all, maybe we have a stop-out. But the next day or perhaps the one after that, but at some point the market is going to serve up long-range days and some great trending price action and the system is designed to take advantage of that.

Traders don’t like to admit it (or believe it), but they are at the mercy of market conditions.