Potential Alerts – Pending Alerts – Confirmed Alerts

The Power Trend System gives you plenty of “heads-up” advance notice before you’ll actually pull the trigger and enter a trade.

This is a great feature because you’ll have plenty of time to react when a trade is imminent. The software will give both audio and visual Alerts when there’s a “potential” trade, a “pending” trade and a “confirmed” trade entry.

Here’s how the sequence of events for each Alert plays out.

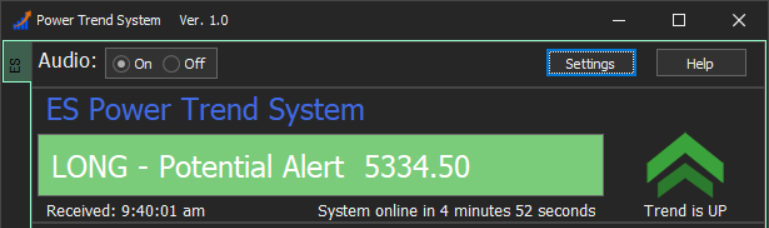

Potential Alert

When the Power Trend System senses the market conditions are “potentially” setting up for a trade, it will display the Potential Trade “Alert Banner” in the top section of the screen. A Potential Alert means just that – there might be a trade coming up, so that’s your initial “heads-up”. Lots of Potential Alerts will not make it to the next stage.

Every trade will begin with a Potential Alert. Frequently there are a series of Potential Alerts before an actual trade will be taken. If the market conditions that initiated the Potential Alert are no longer met (due to price behavior) the Alert will “end” and the Alert Banner at the top of the screen will go back to “System Hunting Trade Setup”. Note that it’s common to see a series of Potential Alerts that may come and go with different price levels. The important price level is displayed at the next stage, when a Potential Alert “sticks” and turns into an Entry Pending Alert.

Think of the Potential Alert as just a heads-up there might be an actual trade coming up soon

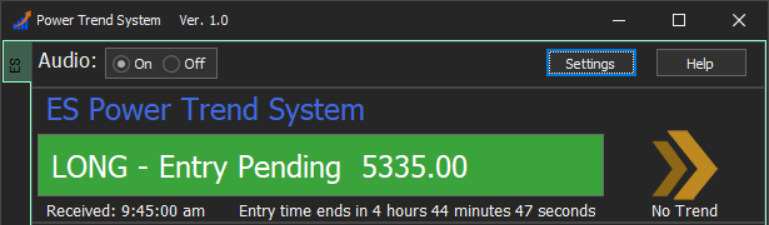

Entry Pending Alert

When the previous “potential” alert turns into an ACTUAL TRADE ALERT, the software will display the Entry Pending Trade “Alert Banner” in the top section of the screen. The Entry Pending Alert means an a trade is about to trigger-in (if the trade fills) so you want to be ready to pull the trigger at any moment at this stage. You will want to have a 1-minute MES chart up and be ready to “enter at market” long or short if / when the Pending Alert triggers-in.

The Entry Pending Alert means a trade is imminent – and could trigger-in at any moment. When you see a potential alert turn into an “Entry Pending” Alert, you want to get ready to enter the trade on the very next 1-minute close (at least a tick) past the Alert price. (see this page for a detailed explanation of the Entry Trigger). The Entry Pending price level is what we call the “Alert Price”. Any Pending Alert will automatically “trigger-in” an actual trade when price closes 1-tick or more past the Entry Pending Alert Price.

The Entry Pending Alert shows the actual Trade Alert Level – and indicates an impending trade just waiting to “trigger-in” or “fill” if the the Entry Trigger conditions are met.

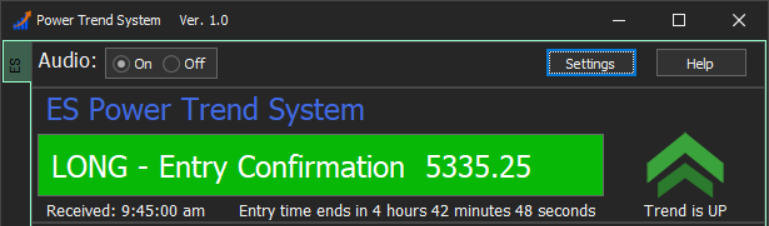

Entry Confirmation Alert

When an Entry Pending Alert “fills” the software displays the Entry Confirmation Alert Banner. That is the price at which the trade triggered-in. It is the CLOSING price of the very next 1-minute price bar that CLOSES at least 1-tick or more PAST the Entry Pending Alert price. (Review the Entry Trigger Strategy page to understand how an Alert “triggers-in”)

Again, the Entry Confirmation price is the exact “fill” the system received on a trade. It’s the exact price the trade “triggered-in”. It’s the price level where the system took a “confirmed entry”. Everything going forward is based on that Entry Confirmation price as far as the Initial Stop and Price Targets. Note that the “Traction” displayed in the software is measured from the Entry Confirmation price level.

When you are trading with the system, you will want to simply place “market orders” and you should get filled very close to the Entry Confirmation price in most cases. The “slippage” you will encounter from trade to trade is no big deal because some trades you will get a better fill than the system and other trades you might get a slightly worse fill. But over a longer series of trades they will even out.

You can use the timer in the lower right hand corner of the software to know exactly when the next 1-minute price bar will close. This can help with entering your trade at the same exact moment as the software “confirms” the Entry.

Note that since the “entry confirmation” is based on a “1-minute close past the alert price” it’s likely that we get filled a couple / few ticks or a couple / few points past the actual Alert Price. This is not a concern because the Stops and Targets are based on the exact Entry Confirmation price (not the alert price). Over a long series of alerts, it won’t matter if some of the fills occur more than a tick past the alert price – it will all even out over time.

The Entry Confirmation price is the exact price where a Pending Alert was “filled”.

The Alert Banner Section of the Software

In addition to times when there’s an actual Trade Alert, the Alert Banner section of the software will display several other relevant messages – most of which are self-explanatory.

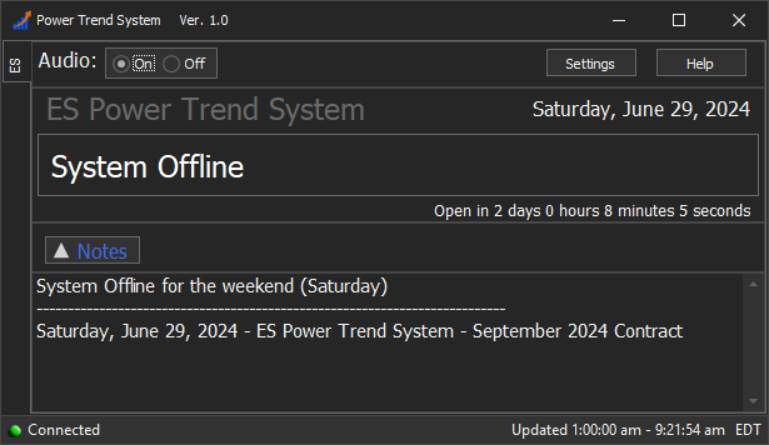

System Offline

When the system is offline (outside normal market hours) the screen will look similar to this. You can see it was offline for the weekend on the image above. Note that on Holiday shortened market sessions where the Futures market closes early – the system will remain offline that session. Market conditions are rarely conducive to trading on holiday shortened sessions.

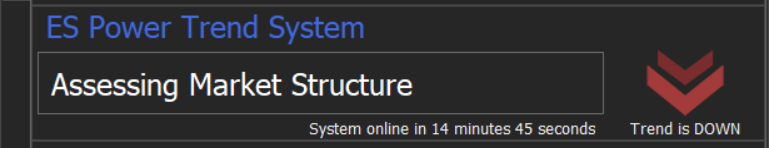

Assessing Market Structure

For the first 15-minutes of each session, the systems internal logic is working behind the scenes “assessing the market structure”. This means that it is analyzing the real-time price behavior right after the cash open. It’s measuring the ATR’s and “assessing” the price data and volume, and gathering required information on how the market session is unfolding in early trading. The system gives the market time to open up, settle out and “show its hand” before any potential trades will be taken. This makes perfect sense if you think about it. Most traders avoid the first 15-minutes (or more) of the session before considering taking any trades. This gives the price action a little time to settle out and gives the system time to confirm if there’s a valid trend in place.

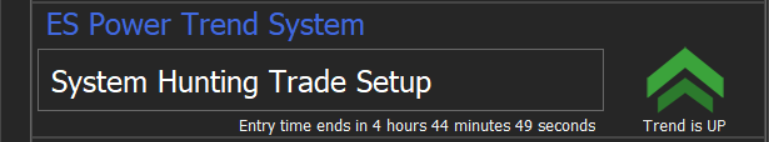

System Hunting Trade Setup

After 15-minutes of analyzing the price action, the system becomes active and a trade can come at any time after that. Note that when a trade is not in progress, you will see the System Hunting Trade Setup message. This is the default message when the system is waiting for a trend shift or a trend reversal. Some sessions, depending on the price behavior the system can be “hunting” for long periods of time – even hours. Remember, the system is looking to identify valid Trend Reversals and many days these can come later in the session. We won’t always see alerts early in the day. Everything the system does is based on how the price action in the market is manifesting at the time. If the market chops around sideways for hours, don’t expect to see any Alerts over that period of time.