Navigating the Power Trend System Alert Software Features

The current version is 1.0 – This is considered a “beta version” since we are releasing the brand-new PTS in June, 2024.

The Power Trend System consists of several components. The Alert Software you have installed is a “receiver”. Our back-end server delivers real-time data to the software. The third component is the logic that drives the signals – alerts – stops – trailing stops and targets. We are able to tweak, calibrate and finely-tune the logic from the back-end without any need to update the Alert Software itself.

This is a significant benefit since the software itself has already been thoroughly tested and is rock-solid. Subsequent updates to the software will only be necessary for cosmetic purposes.

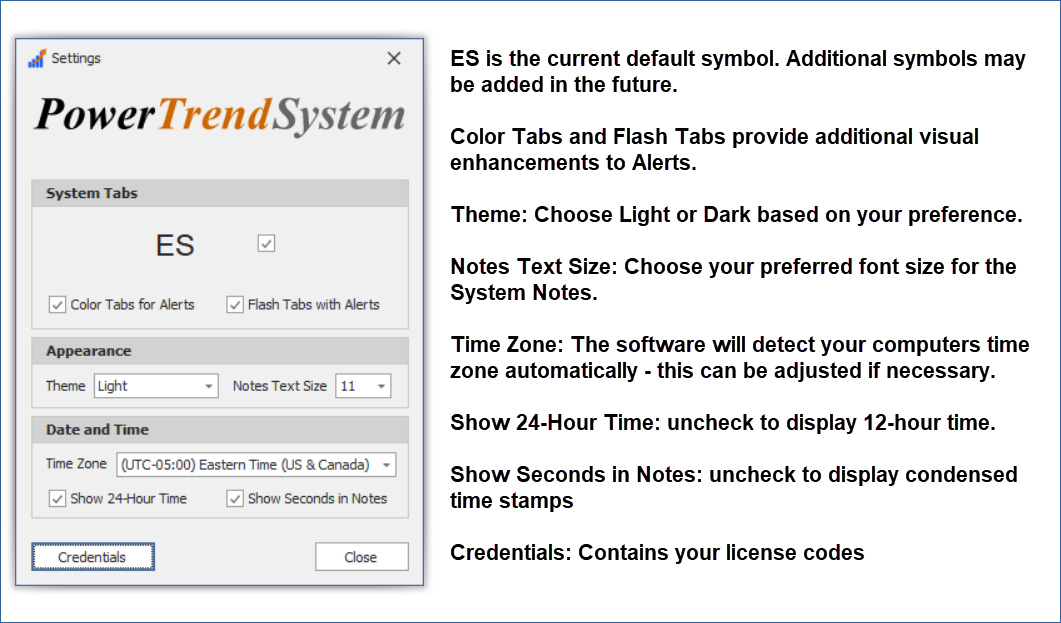

Settings Screen

The Settings screen contains several options for the user to customize the look of the Power Trend System Alert software.

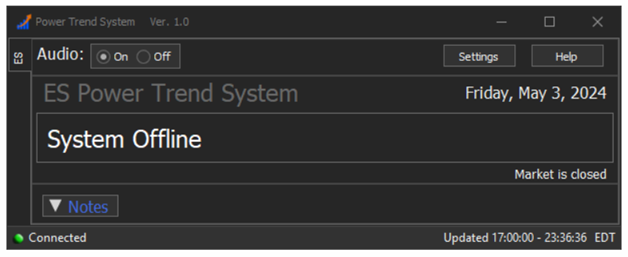

System Offline and Online Status

When the Power Trend System is offline, the software display will be condensed and limited and look something like this.

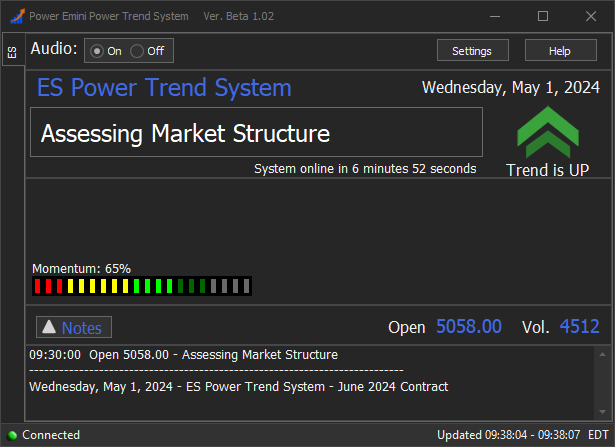

At 9:30 ET as soon as the market cash session “opens” the opening price is posted, and the PTS software will go into a period of limited functionality for the next 15 minutes with a note “assessing market strucure” until 9:45 ET. No entries are allowed during this period, but the open, volume, trend direction, and momentum will be displayed.

The Open Price is the 9:30 AM Eastern Time Futures Market “Cash Open”. The Volume indicator shows the Average Number of Contracts traded over a 3-minute rolling period. It’s useful for gauging market participation. The text will be colored white if the Volume is less than 2,000 Contracts per minute average (low volume). The text will appear blue if the Volume is averaging over 2,000 Contracts per minute traded over the last 3 minutes. It does not affect whether Alerts are generated or whether an Alert should be traded. It updates every couple minutes and is included to help provide insight into the current participation in the market.

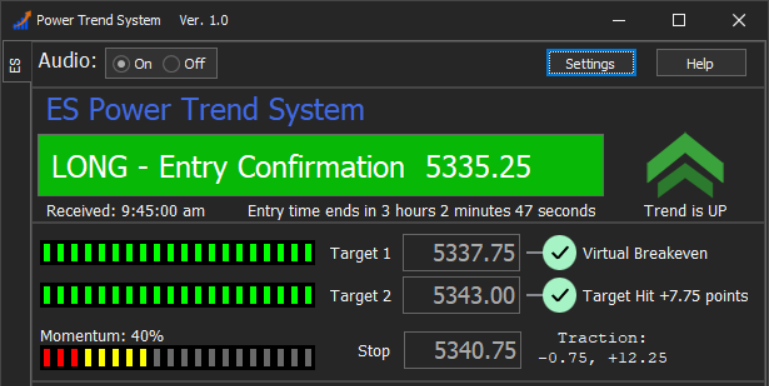

Power Trend System Alert Software Top Section

1) The Audio On / Off radio button selection lets you turn on of off Audio Alerts. It’s on by default.

2) The Settings Button opens the Setting screen that allows you to customize several features in the software

3) The Help button opens and points your default browser to the software help / documentation website

4) The Banner Section displays the current Status of the software or Alert.

5) The Trend Direction indicator displays the current intraday market trend. Note that it won’t always point in the same direction as an Alert. We might have an active Long trade in progress, but the market is consolidating sideways at the moment. The Trend Direction indicator does not affect Alerts in any way.

6) The “Received:” Time Stamp displays the exact time a current Alert was originally generated. The message section to the right of the Alert Time Stamp displays various relevant information and messages which are basically self-explanatory.

7) The Progress Meters to the Left of the Targets display the price progress towards the 2 Targets. If price is half-way to a Target, the meter will be lit up at the mid-way point. Note that the Progress Meters ebb and flow and show a darker green if price backs-away from the Targets.

8) Target 1 and Target 2 are displayed. When price hits a Target, the green check-mark appears to the right of it. It indicates Virtual Breakeven is achieved at Target 1 and shows the points gained from the Entry Confirmation to the right of Target 2 when it’s hit.

9) The Momentum Meter shows the current “inertia” in the market. It’s a useful gauge for determining the current “action” and participation in the market. It does not affect whether an Alert is generated or if an Alert should be traded.

10) The Traction indicator displays the “maximum price excursion” below and above the current Alert’s Entry Confirmation price. This shows us how much “heat” we took on any given alert and what the potential max point move was. It’s not only an ideal way of “scoring” each alert but is particularly useful in the case of “runners” that blast through both Targets and continue to run in the direction of the trade Alert.