Understanding the Power Trend System Logic

We want to start each session with the possibility of catching the first early directional trend move of the day. Some days the market opens and picks a direction and makes a significant point move right out of the gate. However, the opening 10-20 minutes of most sessions is “dicey” and many times price gyrates up and down until the buyers or sellers can establish a trend.

It’s not uncommon to see a fake-out move in early trading where price moves in one direction and then reverses quickly after 10-20 minutes.

The software assesses the early price action and market structure for the first 15-minutes to determine if there’s an early directional trend we want to jump into. This is what we call the Opening Trend Continuation Alert which is different than the subsequent trend-shift / trend-reversal Alerts.

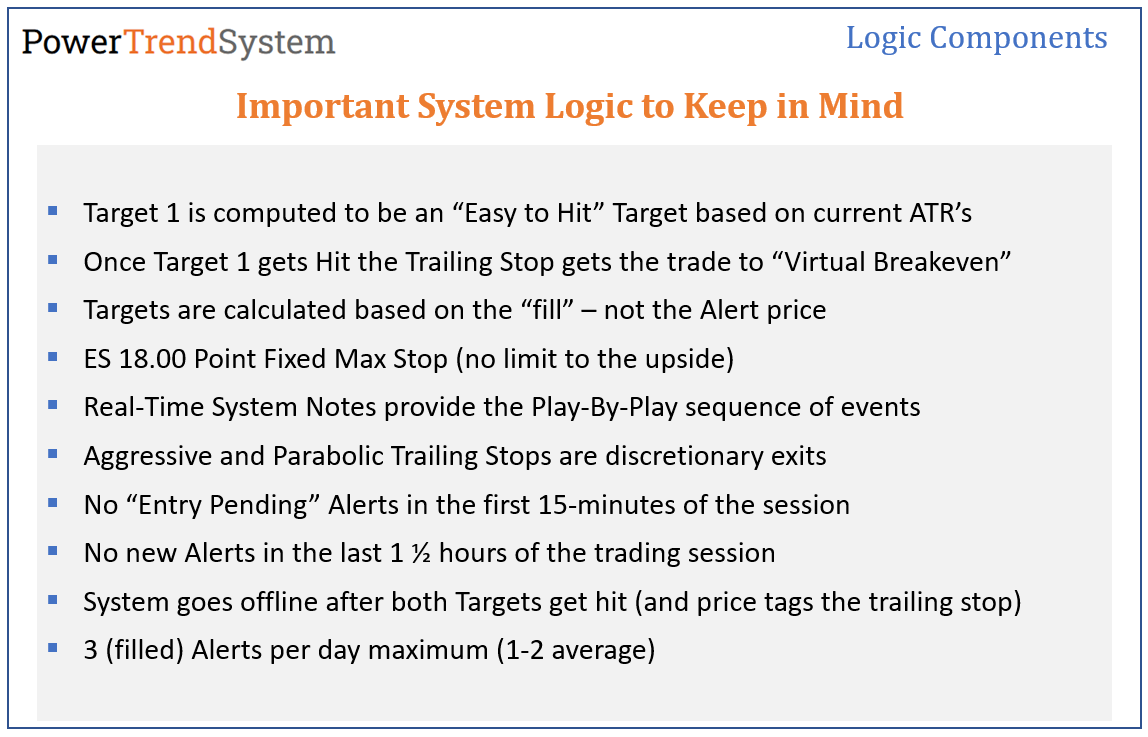

Here’s what makes the system work:

If / When price moves from point A to point B it has to pass through our 2 Targets. This is a law of physics.

If we set 2 targets in between point A and point B we can lock-in profits at each of the Targets. We can also choose to hold a contract for a move past Target 2.

Scaling Out at Targets:

The first Target (T1) is intended to be an “easy to hit” target and we will take partial profits there. At the same time, the Initial Stop will ratchet an equal distance from the Entry to T1 (putting the trade at Virtual Breakeven).

When T1 gets hit we have no risk of a loss on that trade going forward.

Target 1 is calibrated to get hit roughly 70% of the time. If Target 1 was 1-tick we could hit it 90-something percent of the time. But we want T1 to be the ideal distance away from the current price action so that we can lock-in some profits and get to Virtual Breakeven, and still have the trailed-stop distance far enough away to keep us in the trade through normal volatility.

(This is why stops, targets and trailing stops are calculated based on the current ATR’s in the market)

We are shooting for Target 2. That’s where the BIG points are scored.

Target 2 should be as far away from the entry as possible, while still being attainable. When the market trends from point A to point B we will lock-in profits at T1 and T2.

Since the Targets and stops are based on the current real-time ATR’s in the market, the calibration of the targets and stops are the most crucial aspect of the system. They are optimized, dynamic and automatically adjust to real-time market conditions. They also adjust over longer periods of time to the overall market environment as the volatility ebbs and flows through market cycles.

The Trade Trigger:

A good trade setup includes a “trigger” as an additional filter to refine our entries – rather than just saying “here’s a trade setup, let’s take a trade”. The system uses a 1-minute close past the “Entry Pending Alert” price to help verify forward-momentum in the direction of the Alert. We assume the participants that were able to CLOSE the price over our “Alert price / trade barrier / line in the sand” can create enough additional buying or selling pressure to push price to at least the first Target.

Once a trade triggers-in, we are assuming the “inertia” (object in motion / price) will have enough follow-through enough to make it to at least Target 1, at which point we are at breakeven. Once that occurs we are positioned perfectly for large gains if the trend continues.

We know the market always has and always will have “long range days”. Those days will be the big point scoring days for the system. We have to be patient during dull narrow-range, non-trending market conditions. There will be lots of breakeven trades.

Initial Stop and Trailing Stops:

The Initial Stop on any trade is one of the most important things to get right.

Many novice traders think that setting extremely tight stops is the best “risk management” when in fact studies have been done that suggest a wider stop is preferable, and position sizing is the best way to control risk. (source: Market Wizards)

If we set our initial stop too tight, we are likely to get knocked-out of a trade due to normal price fluctuation and minor counter-trend moves. Tight stops are more likely to get hit, and then the trade ends up working out exactly as you had hoped. But you took a loss and missed out because the stop was improperly set.

If instead we set the initial stop just far enough away from our entry to accommodate normal volatility, we give price some breathing room and are less likely to get stopped-out only to watch the price move in the direction of our original trade.

The Power Trend System calculates the optimal Initial Stop based on the market structure and current ATR’s.

Once price begins to move in our favor, the Initial Stop “ratchets” and turns into a Trailing Stop. The Trailing Stops remain active and ratchets periodically throughout the entire trend move until eventually it gets tagged by the price. NOTE: Some sessions the Trailing Stop never gets hit so you will want to close any open positions before day trading margin cut-off time. The System goes offline at the 4:00 NY close each day.

The Trailing Stops are designed to protect profits and lock-in gains. If price makes it to our breakeven level at T1 and continues to move towards T2 but doesn’t quite make it, the Trailing Stops will still protect the bulk of the gains. However it is designed to hang back just far enough from the current price action to keep us in the trade through normal price fluctuation and volatility.

Position Sizing – Scaling Contracts:

Position Sizing is one of the key aspects to developing an edge in trading. Our Trade Plan provides a step-by-step roadmap to success if followed properly. The “secret” is that we start off small and only scale-up after profitable periods and scale-back after drawdowns. That optimizes our position size based on market conditions. You will find that overall market conditions are the main factor that affect the system results. In other words, the system performs best in certain market conditions and when market conditions are sub-optimal (to trading in general) the results will reflect that.

The Power Trend System is designed to be traded with MES the S&P Futures Micro Contract, which is $5 per point per contract.

This allows us to start off small and scale-up our position size over time. It also provides maximum flexibility for adjusting our position size based on market conditions. See the Power Trend System Trade Plan for specific details.

Market Conditions and Performance:

Every trader would be wise to adjust their expectations to be consistent with current market conditions. We have to trade what the market is serving up today.

If we can “stay in the game” through poor market conditions, the system will more than make up for drawdowns over a longer series of trades. The larger the data set (number of trades) that’s where we will realize the “edge” the system provides. The edge comes from the structure of all these various components, including our strategies and tactics. A reasonable sample size is roughly 100 Alerts / Trades. The performance of any one trade or market session is irrelevant. There will be stop outs and losing days. There will be breakeven sessions. The edge is attained over the longer series.

See this page for details on How Market Conditions Affect the System

The system can be traded purely mechanically. Or we can choose to use some discretion at any point based on what we see unfolding in the market at the time.