Understanding the Targets

The moment an Entry Pending Alert triggers-in, the Alert Banner displays the Entry Confirmation level and the Alert is now an active “open trade”. It will remain active until price hits the Stop displayed in the top section of the software (just under the Targets).

The Power Trend System generates 2 Macro Targets once a Trade Entry is confirmed. These are profit exits and are based on current Market Internals/Conditions. The basic strategy for trading the system is to sell a Contract(s) at each of the 2 Targets.

The basic concept of the Power Trend system is that it identifies trends and trend reversals where price can BREAK INTO the Free and Clear and RUN toward the next price obstacle in its path. The System Macro Targets are calculated to be HIGH PROBABILITY FILL zones before price gets to the next obstacle in it’s path which may halt further price movement in that direction. Targets and Stops are “dynamic”, based on the ATR’s and Ranges in the market – and adapt to any type of market environment.

The System Auto Trailing stop is designed for RUNNERS and BIG TREND MOVES. i.e. once a trade takes off past the Alert Price the trailing stop will kick in and attempt to maintain a wide enough distance to allow for normal price fluctuation without knocking us out of the trade only to watch the market eventually make the directional move we anticipated. However the trailing stops do a great job of protecting profits once a trade gets off the launchpad and makes a good move in our favor.

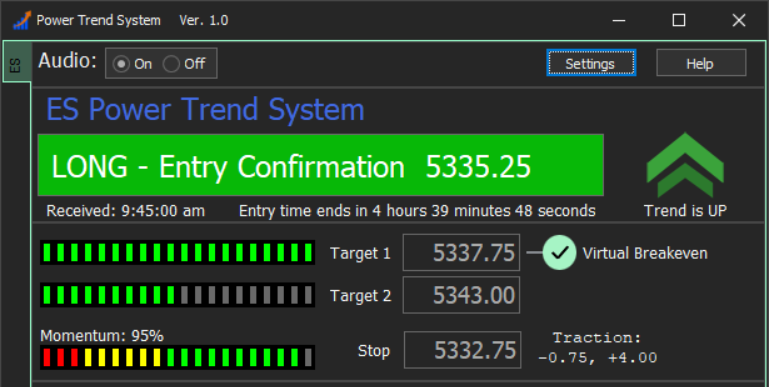

The Progress Meters provide a visual display of the price progress towards the Targets. When Target 1 gets hit, the green check-mark will light up and display “Virtual Breakeven”. This means that with a 2 Contract trade, selling a Contract at Target 1 puts the trade in a no-lose position. The trade is at breakeven because the instant Target 1 gets hit, the Initial Stop “ratchets / trails” an equal distance from the Entry to Target 1. In other words, if Target 1 was 4.00 points above the Entry, when it gets hit, the Trailing stop will ratchet to exactly 4.00 points away from the Entry. The basic strategy is to sell a contract and take partial profits at Target 1.

Target 1 hit – Virtual Breakeven

In the image above you can see the the Progress Meter is indicating that the current price is about half-way to Target 2.

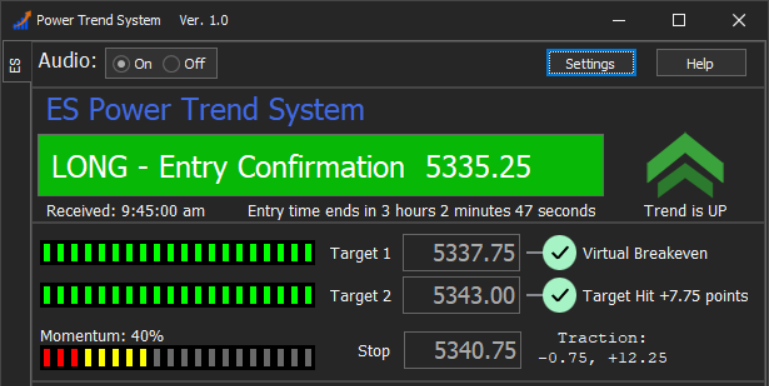

Target 2 Hit

When Target 2 gets hit, you will see the green check-mark light up next to it and display “Target Hit” and the point gain at Target 2. The point gain displayed at T2 is simply the distance from the entry to Target 2 and does not include points locked-in at Target 1.

The Trade Traction display

Note the “Traction” indicator to the right of the Current Stop level. What this tells us is how many points the Alert went against us and how many points the price moved in our favor – from the Entry Confirmation price. This shows us how much “heat” we took on any given alert and what the potential max point move was. It’s not only an ideal way of “scoring” each alert but is particularly useful in the case of “runners” that blast through both Targets and continue to run in the direction of the trade Alert.

Some Alerts will show 0.00 negative Traction. This is when an alert triggers-in and begins moving in our favor instantly and never looked back. In other words the price never moved against us after we took the Entry. This is fairly common and you’ll see lots of alerts that have enough “inertia” to keep moving in the direction of our trade from the moment we get filled.

Understanding The Auto Trailing Stops

The software displays the Initial Stop (which will turn into a Trailing Stop) just below the 2 Targets in the top section of the software. An Alert that triggers-in with an Entry Confirmation will remain active until the price hits the Stop displayed in the top section of the software. If the Stop is not hit by 4:00 Eastern time, the system will go offline at that time. Traders typically close any open positions by 3:45 when intraday margin ends.

It is recommended you place an INITIAL protective HARD STOP based on the initial trailing stop – and adjust your stop as the Trailing Stop moves. Once price is able to make it to the 1st Target you will see the Trailing Stop tighten up. At any point in time you may wish to protect gains or minimize losses by using a tighter stop than the current trailing stop. Remember – the System Trailing Stop is designed to stay far enough away from the current price so that normal price fluctuation and counter-trend moves won’t knock us out of a trade – and we can stay in for the bigger trend moves.

The numbers next to the Trailing Stop in the System Notes indicate how many points that stop is away from the Entry price.

Remember this important point – The Power Trend System incorporates a fixed “maximum stop” of 18.00 points. Generally speaking it’s not common to see the initial stop at the max 18 points, but in volatile market conditions with wide ATR’s, the system will never take a stop-out greater than 18.00 ES points. There’s no max upside limit for the targets.

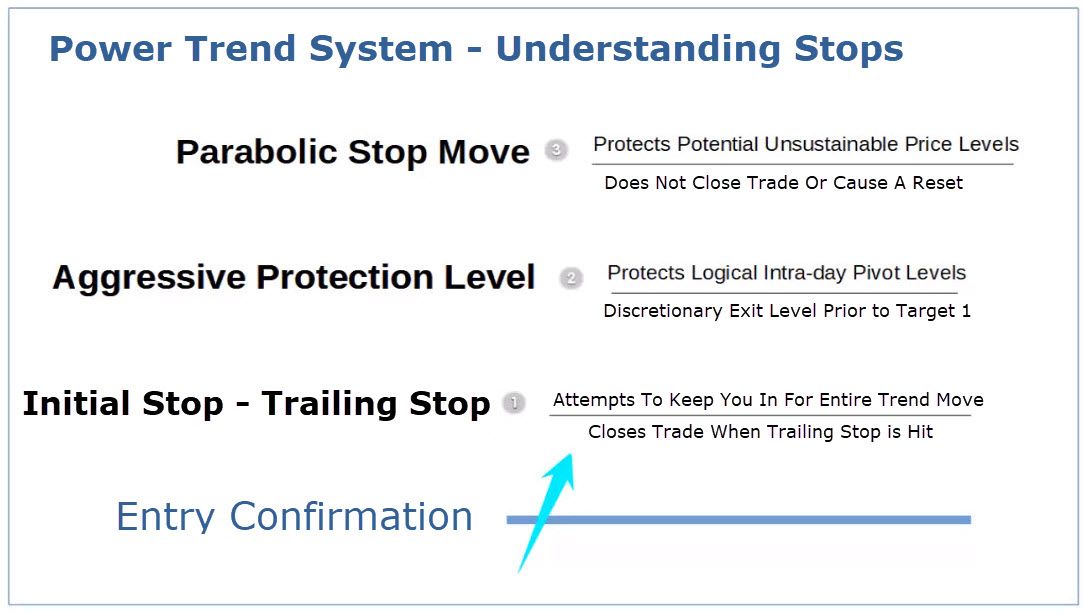

There are 3 different types of Stops incorporated into the system, however only the regular System Stop will close a trade. The regular System Stop is displayed in the top section of the software under the Targets.

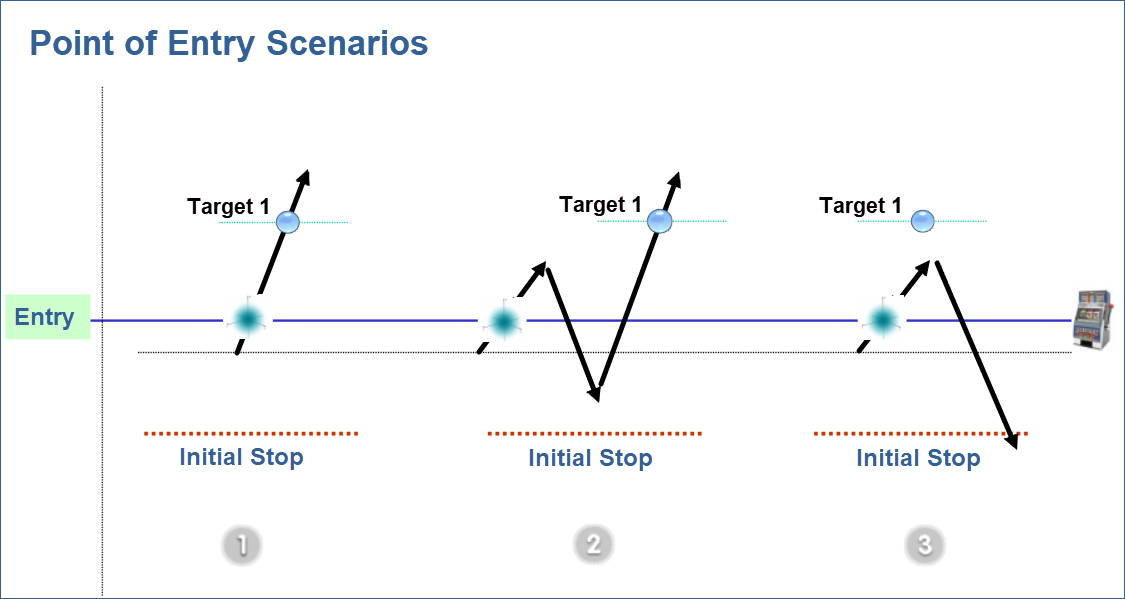

1) The Initial Stop is the hard protective stop that is immediately calculated and displayed when there’s an Entry Confirmation. The Initial Stop is based on the current ATR’s in the market and is designed to start off fairly wide so the trade isn’t knocked-out by normal price fluctuation. When Target 1 is hit, the Initial Stop “ratchets” an equal distance from the Entry Confirmation to Target 1. This puts the trade at Virtual Breakeven for 2 Contract traders that sell one Contract at Target 1.

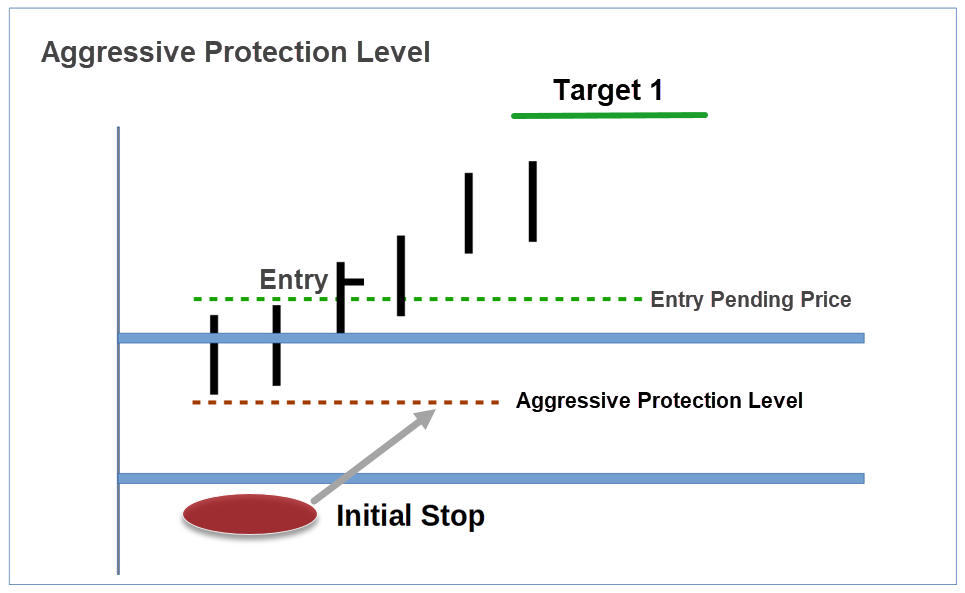

2) The Aggressive Protection Level only appears in the System Notes and serves two purposes. First, it will kick-in and appear in the System Notes when price gets close to Target 1. It’s a “discretionary” tighter stop level a user can choose to exit on to reduce the damage from a Full Stop Out. NOTE: The trade will not be closed if / when price hits the Aggressive Protection Level. The second purpose of the Aggressive Protection Level is to provide a discretionary tighter stop once price gets past one or more of the Targets. A user that is trading multiple contracts can choose to “protect” some or all of the position at the Aggressive Protection Level.

3) The Parabolic Stop appears in the System Notes when the price makes a significant thrust in a short amount of time and is extremely extended due to that move. The Parabolic Stop is relatively rare and generally only appears when there’s a news item that causes a parabolic price move in a short amount of time. The Parabolic Stop is a discretionary level where a user can choose to protect the majority of the gains in a trade. The Parabolic Stop will not close a trade or cause a system reset.

A System Reset means that an open trade gets closed and the banner goes back to Hunting Trade Setup. This can only happen when the price hits the regular System Stop displayed in the top section of the software, which will be either the Initial Stop or the Trailing Stop.

The Aggressive Protection Level and the Parabolic Stop are “discretionary exit levels”.

Once the market starts trending in our favor and hits Target 1 we will see scenarios where the price will be bracketed in between Target 2 and the Trailing Stop. i.e. the trade becomes a WIN/WIN … we will be taken out by one or the other.. either results in a profitable trade. The system does a great job of protecting gains past the Targets utilizing the Trailing Stops.

Some Alerts the price action may trigger us into a false move – we get filled and the price never makes it to Target 1. Price subsequently reverses and moves in the opposite direction and hits the Initial Stop. Alerts that hit the full stop are inevitable. The good news is that the system is self-correcting – and over a larger series of Alerts (bigger data sample) – the system should always be profitable over a long series of trades based on the high hit rate of Target 1.

Keep in mind that each Alert in a given session will have different Stops and Targets based on the current ATR’s at the time. So it’s possible to have an Alert early in the day with a tight stop and close-in Targets and then later the market action heats up and the next Alert has a wider stop and much further out targets.

The best approach is to evaluate the performance at the end of each week. And don’t get hung up on each single Alert. Some days the first alert may get stopped out, but we get a subsequent alert that goes on to hit both Targets – resulting in a profit or near breakeven that session.

The Power Trend System is designed to get us in on a Strong Trending Move – What we call a Trend Runner (significant point moves). Not every day will be a trending day, where price takes off in one direction and never looks back – but these days do occur frequently and that’s where the big money is made. As you follow the system over time you will see days where ES moves 20-50 points or more and it is possible to capture these type of moves by holding onto a position, even after the first 2 Targets are hit. These type of days will more than make up for “full stop out” days.

The success of any day will depend on the level of momentum in the market during the period we are actively trading it. On a super high momentum day… we may be able to Hit both of the 2 Targets without breaking a sweat and then the price continues to move in our favor – resulting in a huge gain on any remaining contracts held past T2. Other days when there is little or no momentum it may be impossible to get any traction on our entries and trades will end up hitting the full stop.

Understanding that the outcome of every trade depends entirely on the levels of Momentum (and that momentum can increase or decrease in the blink of an eye) will help you to become a better System Trader. Remember the job of the Power Trend System is to alert us to Trend Reversals based on a set of predefined criteria. That’s it. The follow-through and the success or failure of any given trade will be related to the strength of the Momentum in the market after we take our entry. (…as well as the degree of price volatility currently in the market.) We are “playing the odds”. The Power Trend System wins over the cumulative series of trades even though we may experience periods of low momentum conditions that make trading tough and frustrating. (like a disgruntled surfer waiting for some good waves to come in.)