Getting Started with the System – Important Points

Start off slow and take your time absorbing all the information.

When you first get started with the system, take some time to just observe (maybe a few sessions or even a week). Learn the Entry Trigger strategy first and make sure you understand how the software “triggers-in” a trade with the Entry Confirmation after you see a Pending Alert.

There’s a lot to take in all at once. In order to get a good grasp on the software / system / strategy you will want to experience multiple market sessions – to see how the system reacts in different situations. There’s no rush to trade live and you don’t want to risk real money until you fully understand all the little nuances of the system. If you just spend a few sessions observing – while going back over the documentation, you’ll have a good understanding of how everything works in a short amount of time.

We recommend trading the Power Trend System with the MES Micro Futures Contracts since it employs wide stops and targets

The Power Trend System is a Trend Following and Trend Reversal system

The system assumes there will be certain trending days, where price picks a direction early in the session – and never looks back. We don’t want to miss a big directional move that starts early in the session and may or may not continue the rest of the day. So the system employs two different types of “trend catching” strategies. The first is the Opening Trend Continuation trade and the second is the Trend Shift / Trend Reversal trade.

How each Alert plays out after the Entry is dependent on the subsequent price action

Any given Alert is at the mercy of the market / price action so to speak. In other words, how the price action manifests at any given time will determine the success or failure of any one Alert. If there’s an anomaly (say price spikes 10 points in a couple seconds) that will affect whether a Target or Stop gets hit. There will be occasional unusual price behavior that will cause the Targets to get hit in an instant – or thwart the system and result in a stop-out. This is more likely when economic numbers are released or some breaking news hits the wires. You could have the best trade setup ever invented that gets “thwarted” by breaking news and erroneous price spikes that don’t obey the rules of technical analysis. Often times a price spike will work in your favor and result in both Targets getting hit immediately.

The Power Trend System assumes there will be enough “forward momentum” in the direction of a filled Alert to carry it to the first Target.

We want to assume that the buyers or sellers that drove price to the level where the system gets a “fill” have enough fire-power to push price just a little bit more – to Target 1. The “inertia” of an existing impulse move has a high-probability of following-through to our Targets. The initial stop will always ratchet to Virtual Breakeven after Target 1 gets hit. Typically the initial stop will tighten up prior to T1 getting hit and display the Aggressive Protection Level. The user much choose whether to “protect” the position at that tighter stop level or stick with the Initial Stop. The system will NOT close the trade if the Aggressive Protection Level gets hit. Open Alerts are only closed when the main system Trailing stop (displayed in the upper-section of the software) gets hit.

Due to the selective nature of the Alerts, it’s going to miss some moves

Which would you prefer in a trading system? Activity or accuracy? The system is looking for strongly-trending moves and trend reversals that have strong momentum and “inertia”. Not every trend is created equally. There will be times where the price just sort of drifts slowly in one direction or the other without any real “force”. At times when price just seems to be meandering around and drifting the system may not give an Alert (or more likely an Alert will not get triggered-in) yet the price does eventually end up moving in one direction or the other. The system is set so that if an Alert isn’t filled within 15-minutes of the Entry Pending Alert it will reset back to Hunting Trade Setup. We don’t want to take low-probability wishy-washy price moves in the hopes that it will continue in the direction of a questionable trend. The system is designed to take trades on forceful trend moves and trend reversals. We prefer accuracy to activity.

The system may fire off a lot of “Potential” alerts, but only the most viable, high-probability trend reversals will “stick” and produce an Entry Pending Alert. Our 1-minute close past the Pending Alert price refines the entry strategy even more. This is how the system attempts to avoid getting triggered-in on false moves. Due to the rigorous selectivity, it is possible that we will miss some decent moves. But as they say “there’s always another train leaving the station”. The system is designed to take advantage of high-velocity trend moves.

There will be days where no alerts trigger-in at all.

This is likely to be fairly rare but still a possibility. As much as we’d like to see great price action and good trending moves every day, the market doesn’t always provide the type of price behavior that lends itself to catching trend reversals and trend moves. Think of those days as sessions where the system kept us out of sub-optimal market conditions. Trading the Power Trend System requires patience. And you know the old saying “patience pays off”. Patience is a virtue. “Patience is the companion of wisdom.”

The market frequently reverses direction mid-day

There will be sessions where we may or may not get a trade in the first part of the session. Early in the day we may see lots of Alerts that never trigger-in. We could get a series of Potential Alerts in either or both directions but nothing sticks simply due to the price action. Those type of sessions frequently see a mid-day or afternoon trend shift or trend reversal so an actual trade may occur later in the day or the afternoon session. Some of the best trades might not occur until hours into the session.

The Power Trend System will frequently give an alert shortly after the high or low of the day is in. Like magic. And what’s better is that the Initial Stop will frequently be just above THE high or low of the session. So in essence IF the trend reversal occurs at (what turns out to be) the high or low of the day, the system will “nail it”. Many sessions it takes a bit of time for that scenario to unfold. In other words we might be a couple hours into the session or more before the trend shifts at the actual days high or low.

Don’t expect every Alert to hit the Targets

The system was designed to have an “edge” over a long series of trades. There will be lots of stop-outs, so you can’t let any one stop-out or bad session bother you. Every trader and every type of system experiences stop-outs. It’s just “the nature of the business” and one of the outcomes that goes along with trading. Every successful trader knows that there will be trades that don’t work – stops get hit – and learns to shrug them off and move on to the next trade. There will also be lots of “breakeven” trades due to the nature of our strategy if you are trading 2 Contracts. This is when the price hits Target 1 but doesn’t make it to Target 2 and there’s not enough additional price traction past T1 for additional Trailing Stop ratchets.

In any type of trading there are always hot and cold streaks. The Power Trend System performance will go through periods where targets are getting hit like shooting fish in a barrel, and “rough patches” where the price action and behavior isn’t as conducive to the nature of the system. Remember, the outcome of any given alert is a function of the market behavior and how the price manifests after an Alert is filled. It doesn’t try to predict market behavior, it simply “reacts” to the current price action. If the market is choppy, listless or erratic, there may not be follow-through in the direction of the trend Alert.

The system performs best when the market is trending on the daily timeframe

A daily chart of SPY gives the best overall look into what transpired during the ES cash session. There are times when the market is stuck in a small congestion area and there’s no real intraday trending action. These are more difficult times for trading no matter what type of system you’re using, as the price just seems to clang around randomly in a tight range – sometimes for days. As we all know, the market environment evolves and changes over time. There are periods of high volatility and times where the market itself is dull. Market conditions play an important role in any type of trading and the system really shines in “fast markets” where there’s lots of action, volume and price movement. We recommend trading more aggressively in fast markets and scaling back during boring listless conditions, which are always temporary. When the price on the daily chart is making a directional move, the intraday trading conditions tend to be better too.

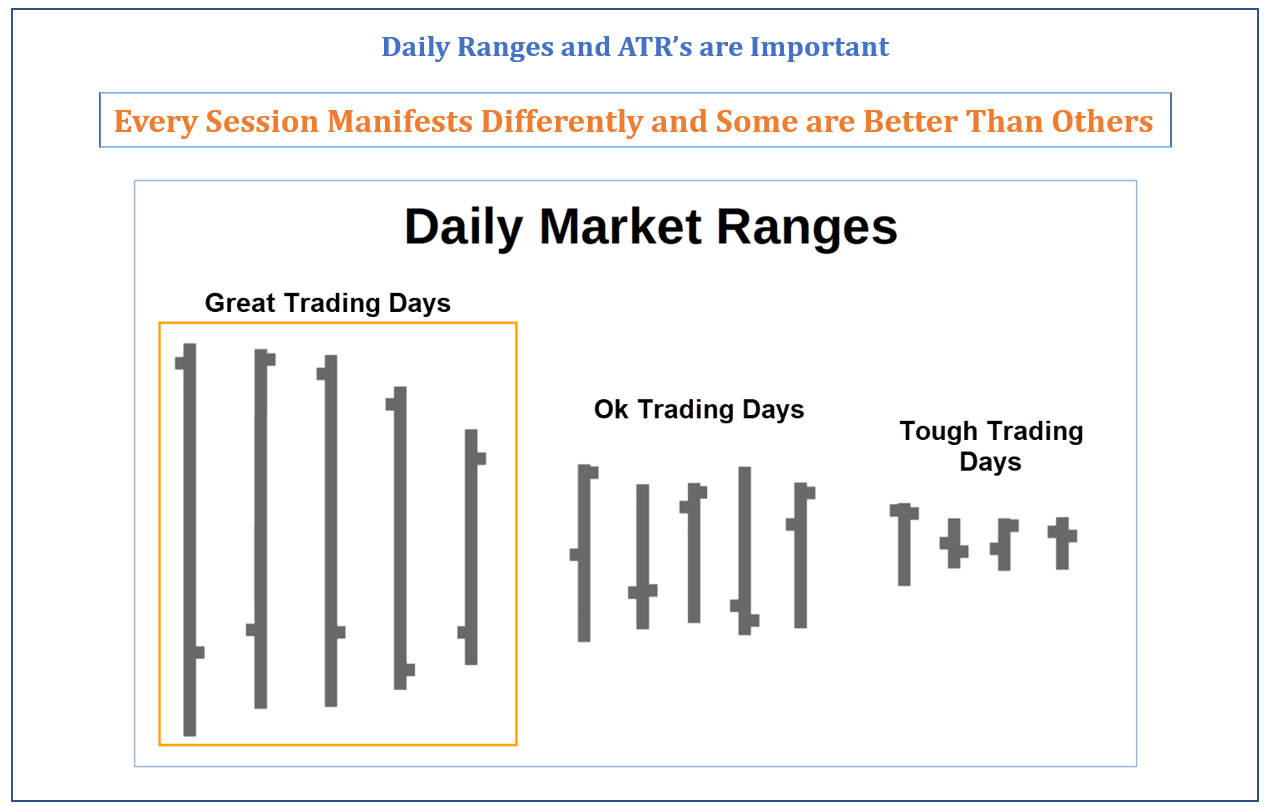

Market “Day Types” will affect the system performance on any given session

Ideally the market would trend every day, but that’s just not the case. The market experiences various “day types” from session to session. Days with very little price movement are not ideal for trading and sometimes the market just chops around sideways or has little price movement. The image below shows how different Day Types are likely to affect system performance. Keep in mind the Power Trend System is calibrated to use the current ranges and ATR’s in the market to determine where the Stops and Targets are placed. Volatile long-range days will have wider stops and way further out Targets than narrow range days.

Holidays and right around 3-day weekends are usually not optimal periods of time for trading

The day before a long Holiday weekend – and around Christmas and New Year Holidays – the market tends to have less participation and conditions are typically not ideal for trading. On Holiday abbreviated sessions, where the market closes early, the Power Trend System will remain offline. We don’t recommend trading on Fed interest rate announcement days. The market reaction after the announcement is a crap-shoot and if there’s an open Alert, it’s likely to hit the stop or targets almost immediately. If there’s no open trade, it’s possible to get an Alert that triggers-in way past the Alert price and hits the stop or the targets before you even have time to react. There’s just no edge trading the volatility that transpires on Fed announcement days.

Reaction Times

Since the Power Trend System runs and registers everything in real-time, it’s possible to have a situation where you aren’t able to react as fast as the system. This is fairly rare but you may experience it from time to time. An example is that the system gets filled on an Entry Pending Alert and a few seconds later the price is already way past Target 1 and the Trailing stop has ratcheted twice. Before you even had a chance to set the Initial Stop or sell at Target 1. In this case it worked in your favor because you can sell at a better price than Target 1.

You will always have at least 1-minute heads-up to enter a trade after you see the Entry Pending Alert.

However in extremely fast markets it’s possible for anything to happen in the very next 1-minute price bar. It’s possible for price to hit both Targets in the 1-minute price bar following an Entry Confirmation. It’s possible for price to hit the Initial Stop. Any combination of events, including Trailing Stop moves can happen very quickly. It’s not something we expect to see very often but you want to be aware of it. Generally speaking these type of events would happen when breaking news is released or when a Fed Announcement hits the wires.

The good news is that these tend to even out over a long series of trades. In other words you might get a price spike in your favor that allows you to take profits past the Targets because they happened so fast. Other times you might miss an opportunity to sell at Target 1 because price spiked to it and then reversed too quickly to react. A simple ATM strategy can help avoid these issues. You can set up an ATM strategy that places a Stop and 2 sell Targets as soon as you click to enter a trade. Just make sure to have it set the stop and targets a good distance away from your entry, then you can adjust them to the correct levels and sit back and let the trade play out. All you have to do is periodically move the Trailing Stop to match the system.

Setting Up Your Charts

The 5-Minute Chart is your best friend for following an open Alert once you’re in a trade

As you know, the Entry on an Entry Pending Alert is based on the 1-minute chart (so you want to be following a 1-minute chart to take entries). But once an Alert triggers-in you will want to switch to a 5-minute chart to follow along – for several reasons:

1) The 1-minute chart is too “hectic”. There’s just too much noise on a 1-minute chart and watching a 1-min chart is nerve-racking. Since we are trading larger trend moves, we don’t want to sweat every little wiggle on the chart and the 5-minute chart gives a much better perspective for our purposes.

2) You want to be able to easily see the stops and targets on the chart since they are typically a large distance away from the current price. A 5-minute chart lets you see the important levels without having to squeeze your chart down vertically.

3) The system is trading the major impulse moves / trends of the session and the 5-minute chart gives you the “bigger picture” view that is consistent with the timeframe it’s working with.

Take the Entry off the 1-minute chart and then switch to a 5-minute chart and sit back and let the trade play out. That’s how you want to do it.

Improve your odds by using a little discretion at times.

The system can be traded purely mechanically – but using some discretion will improve your results.

Over a long series of Alerts and market sessions, you will see certain price action where it makes sense to use some “common sense” discretion. Using some discretion here and there will likely improve your results. Avoiding a handful of full stop-outs will drastically improve the overall results. Generally speaking discretionary tactics are best used under certain conditions – you don’t want to be making judgement calls every session.

Perhaps you’re trading 2 contracts and shooting for both Targets and the price gets in between Target 1 and Target 2. Maybe you’re up 10 points on the second contract and you see the Trailing Stop is quite a distance back from the current price. You might go ahead and decide to take the 10 points and just call it a day, rather than take the chance the price works its way all the way back to the Trailing Stop. You could also choose to use a tighter stop than the system shows – maybe move your stop to a tick past the high or low of a couple bars back – protecting most of the gains.

At any point in time, you can choose to use a different trailing stop then the system shows. Remember, the Power Trend System is attempting to play the major trends and trend reversals of the session and as such, the trailing stop “hangs back” at a distance designed to prevent a trade from getting knocked-out from normal price fluctuation, volatility and minor counter-trend moves.

If price gets within a tick or two of Target 1 – and T1 is actually a significant distance from the Entry, you might consider protecting the gain (at the APL) or even going ahead and taking profits a little early – as opposed to taking the chance of a stop-out. This is typically a strategy you would consider if the range is wide and T1 is 6 or more points from the Entry.

If you see the 18 point “fixed maximum stop” is in play – Use caution (you can skip the trade or just trade 1 Micro Contract)

It’s fairly rare to see the max stop come into play – though you will see it. When you do, you must realize that the ATR’s are wide and there is elevated volatility. The risk is higher than normal and you have to decide whether you’re willing to take an 18 point (ES / MES) stop-out (per contract) and be able to just shrug that off. When the market experiences periods of extreme volatility the numbers get a lot bigger. Stops and Targets are “way further out” and you have to adjust your expectations based on the wider ranges.

If the 18 point max stop is in play – and you want to participate – you can just trade 1 Micro Contract and just take 1 Alert / trade that session. It might not be a bad idea to skip the first alert on those days, and take your one shot on the second (or third if there is one) Alert.

Some days if the first Alert hits the Stop – quit for the day

Occasionally the market will serve up a “rotten session” where it’s possible to get stopped out multiple times (3 max). This occurs when the price chops around just enough to trigger-in a trade, then reverses and goes all the way back to the Initial Stop. The system is set to issue a maximum of 3 filled alerts per session, however you can improve your results by identifying market conditions that just aren’t conducive to trading the system in certain sessions – and call it a day after one full stop-out. This is particularly relevant if you get an alert early in the day that hits the stop, then the market meanders around for hours with no real directional bias. You might want to avoid alerts that fire off just prior to the cut-off time of 2:30 Eastern if the market is dull or just drifting.

An Alert that hits both T1 and T2 will make up for an Alert that hits the Full Stop

ES and MES are going to trade a little differently at times

The Alert software runs on the full size ES contract data. There are times where the price of ES and MES diverge ever so slightly and can differ by a tick or two. This usually doesn’t make any difference to the system, however there are certain inflection points where it might. It’s entirely possible for MES to hit a Target or Stop when the ES never traded at that exact level or vice versa. It’s going to be rare but it will happen. So it’s possible when trading MES that the system is going to register the Stop getting hit, or a Target getting hit where there was no fill on MES. So the occasional slight difference can work for you and against you, but over the long run it all evens out and isn’t a big deal.

You can always use a tighter Stop than the system stop

There are times when you might see the initial stop or trailing stop is a large distance from the Entry and it might make sense to use a tighter stop. Say there’s an alert in progress and the initial stop hasn’t ratcheted to the Aggressive Protection Level yet, and the price seems to have hit a level of support or resistance – that it just doesn’t seem to be able to penetrate. When the price begins to reverse and it seems likely it might “revert to the mean” you can choose to use a tighter stop (perhaps the mid-point of the range) to reduce risk – instead of taking a full stop out.

Generally speaking it’s a good idea to be more pro-active and consider using a discretionary stop when the distance from the Entry to the current Stop are 12+ points.

You can always “get back in” an Alert using the same levels

Say you do choose to use the Aggressive Protection Level stop and it gets hit – then the price starts moving back in the direction of the Alert and is close to the Entry Confirmation. It’s ok to take another shot at it using the same setup as before. So essentially you are choosing to reduce the number of points, should the Alert get stopped-out, but ready to re-engage if the price action demonstrates it’s likely to work out after all.

It’s not uncommon for the price to hit Target 1 – the Trailing Stop tightens to Virtual Breakeven – and price reverses just enough to knock-out the trade, then continues on to hit T2 as the trend continues. In order to get a new Alert, the price will have to reverse and trade in the opposite direction. So there will be breakeven trades that “would have worked” but don’t because we are using the Virtual Breakeven strategy. Don’t get frustrated because Virtual Breakeven is a big part of what tilts the odds in our favor over the long-run. In this case you could choose to “get back in” using the same criteria as the previous Alert if it seems obvious the market is going to trend in the direction of the original Alert.

The “Entry Confirmation” or fill on an Alert can make a big difference on how things play out

Ideally, every Alert would get filled just 1-tick past the Entry Pending Alert price. But that’s not how the market works. Since we are using the closing price of the first price bar / candle that CLOSES past the Alert Price, there will be times the system gets a fill WAY PAST the Barrier. It could be 10 points. That would be extremely rare but it can happen. The result is that the Alert was filled WAY above or below the Trigger Range and the price is already very extended. In that case there are a couple options.

1) Pass on that Alert (one Alert filled 30 points past the Alert price some years back – a good example of when to just pass)

2) Set a limit order at the exact Alert price (you may or may not get a fill, but you can use the same distance as the system to YOUR Target 1)

3) Take the trade and use a tighter stop. (recommended when the distance to the Stop is 12+ points)

Target 1 typically gets hit pretty quickly after an Alert fills

When there is good momentum in the market and the price action is fairly active, most times you’ll see T1 get hit relatively quickly. Within a few minutes or perhaps even 15-20 minutes. The price will be actively moving in the direction of the Trend Alert with enough forward “traction” to get to the first Target. There will be times when the price just sort of “drifts” and eventually hits the first Target, but takes a long time – perhaps hours. Everything is a function of the market behavior and price action – which varies drastically over time and through different environments. Anytime an active Alert just doesn’t “look right” feel free to use a tighter stop than the system shows or just close the trade. One session during our testing saw price vacillate 2.75 points above and below our Entry for almost 3 hours.

Sometimes it makes sense to go ahead and just close the trade at Target 1

There are certain sessions where the price action is erratic and choppy, or the liquidity is low and price just seems to be trading randomly all over the map. Sometimes it’s just “stuck” in a congestion area for a long time and it looks highly unlikely it’s going to trend in one direction or the other. Some Alerts you will see Target 1 is a large distance away from the Entry and Target 2 seems so far away it’s highly unlikely it will get hit. The point is that it’s perfectly okay to just go ahead and close trade and take profits at Target 1 sometimes. There have been plenty of Alerts that hit Target 1 for say 5-10 ES points, then just reverse and end up closed at breakeven. Another case where you might want to just go ahead and close a trade is if price hits Target 1 and then just meanders around for too long. Sometimes the market makes a move and then goes into a sideways holding pattern which can last hours. If price is between T1 and T2 you have the option of closing the trade at any point and calling it a day.

Sometimes the price will just “blow through” the Targets

It’s possible to capture more points than selling at Target 1 or Target 2. But that’s going to require some discretion and pro-active management of the stops. When the market is hot and the price action is fast, you’ll often see price just rip right past Target 1 very quickly. If you are actively monitoring an open Alert and don’t already have a limit order to sell, it’s possible to capture extra points by being quick to take profits PAST the Targets. Sometimes a few seconds of hesitation can net you an extra few points in fast markets. There are also strongly trending days where the price goes WAY past Target 2 – and it’s possible to capture a lot of extra points simply by managing the trade with a tighter stop than the system Trailing Stop. Once Target 2 gets hit, the system will typically have the Trailing stop in the vicinity of Target 1. You can also make use of the Aggressive Stop which kicks in from time to time after the Targets get hit. The Parabolic Stop is also useful for helping to protect the maximum gain when price makes a parabolic move.

Don’t get discouraged or worry about any one bad Alert or market session

The Power Trend System is designed to provide an edge over a long series of Alerts. There will be full stop-outs and bad sessions with multiple stop-outs. Typically an Alert that hits both Targets makes up for a full stop-out. Some Alerts will only make it to Target 1 and then reverse back to hit the “ratcheted” Trailing stop for breakeven. Trading is a game of odds and statistically speaking, the larger the data set, the better we can measure the results. In other words, over the course of 100 Alerts, we should see how the system provides the edge. Any one given Alert or session isn’t really relevant as the system is designed to stack the odds in our favor over weeks and months. in other words, don’t sweat the stop-outs or bad sessions and don’t get discouraged when the system encounters a rough patch. Those go along with any type of trading and are just the nature of the game. There will be times where a trade gets knocked-out by 1-tick. There will be sessions where the price comes within a point of Target 2 but never quite makes it. There will be days where an alert fills and then the price just hangs around that zone for hours. There will be alerts that blow right through Target 1 within a couple minutes after the Entry.

Take Time to Familiarize Yourself with all the Little Nuances of the System

When you first start out things seem pretty cut and dry – You see the alerts and how they play out. But after a period of time working with the system you start to notice things that occur as the price action unfolds in relation to the Alerts and levels for the stops and targets. There are sessions where you might decide to just shoot for Target 1 based on what you see on the charts. There are times where an alert might occur right near a major support or resistance level and you might choose to wait to see if it can break through before taking the trade. Once in a while there will be an “anomaly” as far as the price action and you might choose to avoid trading that day. There will be days where the market is clearly trending and you might choose to skip taking profits at Target 1 and pro-actively manage the stop (protecting the majority of the gains) and seeing if you can ride that trend all the way to Target 2 or further.

Having a feel for market conditions and the overall environment will help you decide when to employ some of these discretionary tactics. After a period of time working with the Power Trend System and experiencing how it reacts over all different types of market sessions, you’ll start to get a feel for when to use discretion and when to just stick to the numbers. The price action manifests differently each session and the system is just reacting to what’s unfolding in real-time. Once you get a really good feel for everything by experiencing all sorts of different types of sessions over time, you will come to realize how brilliant the design of the system is – and the “edge” it provides will become more apparent.

Start off slow and follow the Trade Plan and we think you will have good success with the Power Trend System.