Everything You Need to Get Started Trading the New Power Trend System

——————————————————————————

Welcome To Power Trend System Futures Trading!

—————————————————–

The Emini Futures markets provides the day trader with a fantastic highly leveraged trading vehicle that can lead to large profits even for small beginning account holders. However this built in leverage is a double-edged sword and many new futures traders can experience large draw-downs and take losses in their accounts when first starting out as they attempt to work through the learning curve in the beginning.

The Power Trend system a great new ALGO that is both easy to implement and can be followed safely and mechanically without incurring large upfront draw-downs. The Power Trend ALGO wins mechanically OVER THE SERIES and has a built in profit edge simply by following the system generated numbers and NOT attempting to second guess the entries.

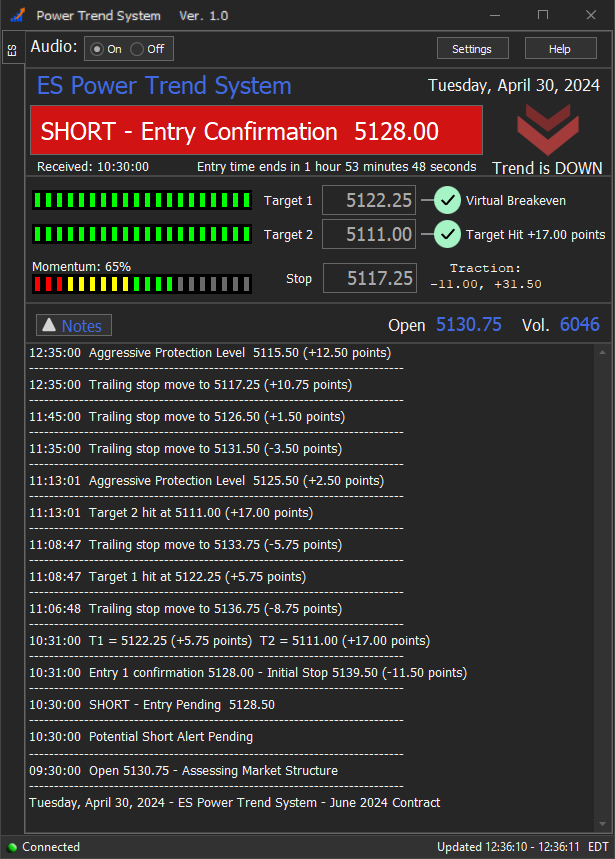

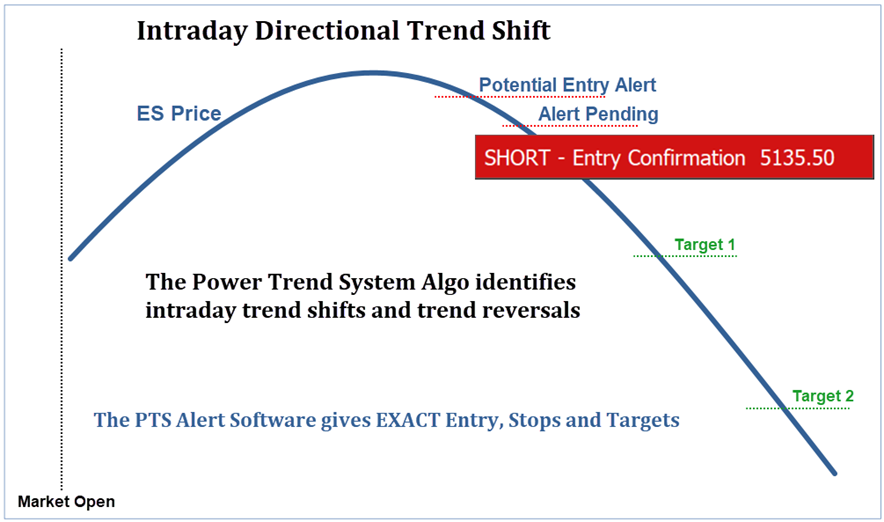

The System works by attempting to identify intraday trend shifts in the market. The basic concept is to plant contracts in the market at key “turning point” levels and let them run as long as possible to capture the larger moves the market makes. The Algo generates heads-up Alerts for “Potential” Long or Short trades. When a potential trade meets the specific criteria for an actual trade, the Alert Banner will display a “Pending Entry”. The Entry Confirmation Banner displays the fill Price when an Alert triggers-in. Once an Entry is Confirmed it displays 2 dynamic Targets as well as an initial protective stop loss level that converts into a trailing stop as price moves in our favor.

The Power Trend System runs for the ES Futures symbol and users can trade the MES based off the same alerts. ES and MES trade in perfect sync except for rare times where the price may differ by a tick, which rarely affects the outcome of an Alert.

Hours of Operation:

The Power Trend System online at 9:30 ET and goes offline at 16:00 ET unless it finishes the trading day sooner.

At 9:30 ET as soon as the market “opens” the opening price is posted, and it will go into a period of limited functionality for the next 15 minutes with a note “assessing market structure” until 9:45 ET. No entries are allowed during this period, but the open, volume, trend direction, and momentum will be displayed.

No new Alerts will be generated in the last 1 1/2 hours of trading (after 2:30 Eastern time) however if an alert is in still progress the system will continue to run until the Trailing Stop is hit or the market closes (at 4:00 Eastern).

If an Alert is “triggered in” with an Entry Confirmation and then goes on to hit both Target 1 and Target 2, when the Trailing Stop gets hit the system will go offline for the remainder of the day. That session is considered a “big win” and there’s no reason to risk giving anything back.

If three trades have completed, the system will end the day.

The system only comes online on full trading days – if there’s a holiday that impacts the above trading hours it will not come online that day and will instead post a holiday message.

Basic Overview Of The Power Trend System

The PTS attempts to identify intra-day trend shifts and trend reversals in the market and keys off real-time ATR’s for its calculations. The system will only issue Long trade alerts when price begins reversing after a down move and only issue Short trade alerts when price reverses after an up move.

Basic Components Of The Power Trend System

1.) Assessing Market Structure

___________________________________

As mentioned above, the Power Trend System keys off ATR based trend reversals as its main trade setup strategy each session. Markets typically make a directional move shortly after the cash session open and then at some point the trend shifts. The system identifies these potential trend shifts early-on, but waits for confirmation before issuing an actual Trade Alert. Dull trendless markets may not have frequent trend shifts and there are sessions where there may be no alerts. Typically you can expect 1-2 Alerts per session with a maximum of 3 filled trades.

2.) Trade Setup Alert

______________________

When the system comes online at the cash open it displays the “Assessing Market Structure” message for the first 15-minutes of trading. This time period is used for performing calculations behind the scenes to identify pertinent information based on early price action. The software displays a countdown timer showing how long until the system actually comes online to begin looking for trade setups.

At exactly 15-minutes into the cash session the message in the upper section of the software changes to “System Hunting Trade Setup” and you will see the message “ES Power Trend System Online” in the System Notes. From this point on the system is looking for specific price action in the market that will signal an Alert.

When the system logic identifies a potential directional change in trend, it will fire off a visual Alert Long or Short and display a Green or Red banner in the upper section. The alert will say “Potential Long or Short Alert” and show the Alert Price Level. IMPORTANT: Potential Alerts are just a heads-up and may or may not “stick” to become an actual trade alert.

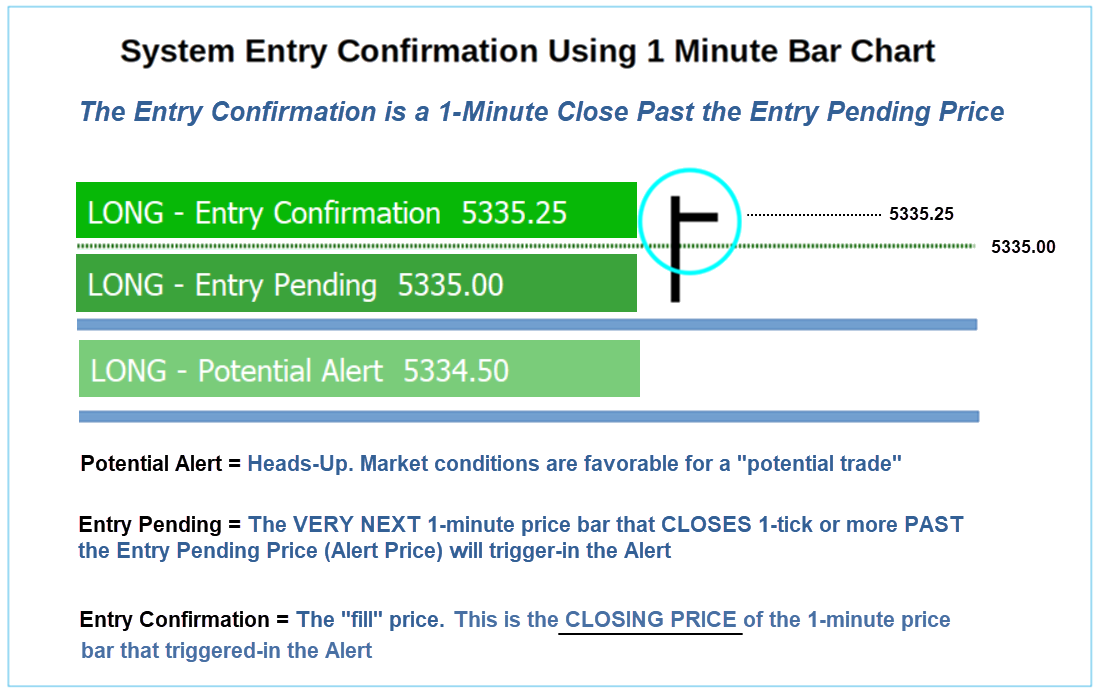

When the system logic determines the trend shift meets all the criteria for an actual trade, the Alert Banner will change to “Entry Pending” and display the actual Alert Price (which is different than the Potential Alert price). An Entry Pending Alert means the system is waiting on an actual “entry trigger”. IMPORTANT: Not all Entry Pending Alerts will fill. The Entry Pending alert price is the trigger line to work with in confirming your final entry. You will typically have 1 minute or more to confirm an entry after an Entry Pending Alert goes out.

Note: You will hear the audio alert when a Potential alert turns into an Entry Pending alert if you have the audio button on.

The “Entry Confirmation” will display in the Alert Banner and System Notes when a trade actually triggers-in. The Entry Confirmation is defined as the very next 1-minute price bar that closes at least 1-tick or more PAST the Entry Pending alert price level. (Note: You will see a time stamp for when the alert was received as well as a Trade Entry Confirmation come through in the system notes section).

3.) Initial Protective Stop

___________________________

When an Alert is generated, once it is “filled” via the Entry Confirmation message, an Initial Protective Stop will be generated. This is a hard stop that you should place which protects against catastrophic loss should we see a runaway market against us. Note: The Initial System Stop can be 8-12 ES points under normal circumstances and larger still during volatile market conditions. The initial stop is based on an average of the current real-time ATR’s in the market. The purpose of the initial wide stop is to give the market enough wiggle-room to allow price to get off the runway and move in our favor without getting knocked out on normal price fluctuation. Although these initial stops are much bigger than what we would use for scalping strategies, which utilize much tighter stops, they are not to be feared as the end results over time still statistically pan out in our favor. i.e. we will have much larger profitable moves in our favor over a series of trades than full stops getting hit. The ES Power Trend System employs a “fixed maximum stop” of 18.00 points.

4.) System Trailing Stop

__________________________

When the market momentum heats up and price begins to trend in our favor the Initial Protective Stop will convert into a Trailing Stop and eventually begin to tighten the gap below your position. As the Power Trend System is designed to keep you in the market for extended moves throughout the session, you will notice that the system trailing stop will give price wide wiggle room and may seem to move slow in comparison to current price movement. The Trailing stop is designed this way on purpose as our main goal is to stay in the primary trend and ride out the volatility.

(One of the worst feelings is to get knocked out of your position by a temporary price spike and then watch the market go onto make a huge move in your favor) In trending markets you will see the system trailing stop eventually pass your entry levels and move on to protect profits. As price continues to move in our favor and we get closer to the end of the session the trailing stop movement will accelerate and tighten to lock in and protect more gains.

5.) System Dynamic Price Targets

_________________________

When an Entry Pending Alert is issued and an Entry confirmed, the system will compute 2 Dynamic Price Targets based off the current average ATR’s and market range profile. Think of these targets as high probability price targets where you have the option to take all or a portion of your position off the table. The system will display the 2 dynamic targets in the top section of the software as well as in the system notes. Note that the system will “trail the stop to virtual breakeven” once Target 1 gets hit. Target 2 is programmed to be a large distance from the Entry (based on current ranges and ATR’s).

The “Traction Meters” to the left of the Targets in the top section of the software display the progress price has made to each of the targets. When Target 1 gets hit you will see the “Virtual Breakeven” message next to that Target. The virtual breakeven means that on a 2 Contract trade – selling 1 Contract at Target 1 to lock in partial profits – the Trailing Stop is an equal distance from the Entry to T1 – so there is no risk of loss on the trade (other than commission or slippage).

6.) Aggressive Protection Level / Parabolic Stop Alerts

___________________________

In addition to the normal Trailing Stop the system employs two additional types of stops. Prior to Target 1 getting hit the system will issue the Aggressive Protection Level (stop) in the System Notes portion of the Alert Software. This is designed for traders that discretionarily choose to tighten the initial stop quickly. At certain times the system may generate an optional Parabolic Stop recommendation. This situation occurs when we see price momentum and trajectory accelerate very quickly to extremely Overbought/Oversold, i.e. unsustainable short term levels. A trader can use the parabolic stop on their entire position to squeeze out final profits after a good run or use it as a protection level on a portion of the trade holding the remainder with the normal trailing stop. Parabolic Stops only get issued when market momentum is extreme. (Note: The Aggressive Protection Level and Parabolic Stop levels are ONLY issued through the System Notes Section of the desktop alert software and do not close the trade if they are hit)

A trade “reset” only occurs when the regular system Trailing Stop is hit.

7.) Confirming Trade Entries

______________________________

When the system issues an “Entry Pending” alert this is NOT to be interpreted as the final entry signal. Instead this price level is a reference point which we will use to CONFIRM our entries. The Entry Pending price represents a “Line-in-the-sand” or “Price level to beat” before we pull the trigger. The system trade entry confirmation is to wait for a 1 minute bar close PAST the Trade Price Barrier AFTER the alert is received. If you wish to follow the system mechanically you must wait for a 1-minute closing bar AFTER you receive the Entry Pending level. Click Here for more detail on the Entry Confirmation strategy.

Winning Over The Series

_________________________

Trading is a game of odds based on timing and tolerances and repetition. A crucial concept to keep in mind regardless of the exact approach you take in following the Power Trend System is that the statistical edge is attained by taking many trades over time, i.e. we win over the series. All strategies and systems have some failure rate and seeing good results from futures trading can at times be slow and frustrating for days when we experience sluggish market conditions. What this means is that you must plan ahead to reserve judgement on your P&L until you have completed a decent number of days following the system, i.e. 10-20 market sessions. In order to manage this though and stay in the game you should start off with very small position sizes so you can push through the series regardless of any temporary upfront drawdowns which would otherwise cause you to halt your trading activity and abandon the system. If your initial position sizes are too big to start with, this is very likely to happen. As your trading performance and profit edge are achieved over a decent set of trades you can begin increasing your position sizes pyramiding to greater and greater size over time, thus increasing your profit potential. It is highly recommended that all new followers of the system spend at least one week trading on SIM mode to work through the basic mechanics and get a feel for follow-through before trading in a live account.

Summary – How To Think About The System Alerts

_______________________________________________

The Power Trend System is designed to get you into, and keep you in a directionally trending market throughout the day session. It is not a short term scalper system and does not attempt to call every twist and turn of the market. As a follower of the system you want to make the assumption each day that the market wants to trend either to the upside or to the downside and the system’s job is to alert us to the best levels to catch the major directional trend shifts in the market that can get significant continuation as the market momentum heats up. The system is not designed around individual trades, but instead gives us a “Playbook” or “Framework” to key our positions off of, i.e. the system issues key price level information which we use as reference points to trade around. The ultimate goal is to catch major trend changes and take advantage of super strongly trending momentum, i.e. long range days, capturing large point gains. The Power Trend System system works great over the series and is designed to be easy on your nerves when trading it with the MES Micro futures contract.

Focus On Each Day Type Instead Of Each Individual Trade

_______________________________________________________

You will do better following the Power Trend System if you get away from thinking about individual trades and focus instead on results from each of the day types the system operates in. We basically see 3 flavors of intra-day market sessions which have a direct correlation to the degree of point capture we will experience following the system.

The first is the super hot trending day where the market is under heavy accumulation or distribution and we see massive amounts directional price movement. These days are by their very nature conducive to large point gains.

The second type we will experience is the V-reversal day where the market first makes a strong move in one direction for a certain amount of time during the session then quickly changes direction to sling-shot back in the opposite direction. These days can blast off in the early session and then return sharply back to the open where they either stop, or continue on crossing the opening price zone and making another large move on the other side of the open. Since the system trades intraday trend reversals, the first example will give us only one good momentum run to work with in one direction and the second example will see two price impulse moves to work long/short.

The third session type is the super dull churn day with limited directional price movement and price just sort of zig-zags up and down randomly in a range. We often see price move back and forth across the opening price zone in cycles of varying magnitude where the market is never able to ignite into a full-blown directional trend. These days can hook us into positions with limited follow-through and this is where we typically experience choppy conditions that run to hit our full initial stops. This day frequently ends as a narrow-range Doji (Open = Close) bar with no considerable price advancement either way. Just confused price action and lack of commitment. Sideways, choppy markets are tough to trade and a discretionary trader might decide to avoid trading in these conditions.

Think of the system as a filter that these different day types must PASS THROUGH each leading to different results.

(1.) Hot Trend Day $$$

(2.) V-Reversal Day $$

(3.) Trend Failure Day ?

The system if followed over the series of days will self-correct after periods of drawdown. The goal is to attempt to maintain a relative break-even status (over a 2-3 day average) until we hit pockets of market action where we Score Big and lock in gains.

Final Recommendations To Get Started

______________________________________

New traders following the Power Trend System should start off with 2 micro contracts and gradually increase position size as performance warrants and experience is gained. This go-slow approach will keep you in the game and allow you to work through the series which allows the statistical system edge to unfold. Following this “Pull-yourself-up-by-your-own-bootstraps” approach will help you avoid large upfront drawdowns as you push through the series and you can methodically pyramid your way to bigger and bigger position sizes and greater and greater point captures over time.